When you enquire about the future of cryptocurrency, you will get varied answers depending on who you enquire from.

Some analysts are confident that this revolutionary currency has a stable role in the future, while others are concerned about its risks.

With Bitcoin surpassing all expectations and approaching its all-time high in mid-November 2020 despite the COVID-19 pandemic, crypto optimists have a reason to believe that digital currency has great potential and might change the way we view the financial industry.

Since December 2020, Bitcoin has more than doubled its value, and this impressive growth could be the begging of a long, bullish run.

Understanding Bitcoin

Before we dig deeper into the future of Bitcoin, it is critical for novices to learn a few things about this hyped cryptocurrency.

Bitcoin is a decentralized currency that utilizes peer-to-peer technology that enables all functions such as transaction processing and verification as well as currency issuance to be done collectively by the network. Bitcoins are created digitally through a process known as mining.

This is a process that requires powerful computers to crunch numbers and solve complex algorithms, even though this process has been simplified thanks to the rise of cloud mining. Currently, Bitcoins are created at a rate of 25 Bitcoins per minute. This crypto is very scarce and is capped at 21 million.

What is a Bitcoin? Read more here.

The future of cryptocurrency in 2021 and beyond

2020 has been a tumultuous year, to say the least. However, the cryptocurrency sector has continued to grow against that backdrop. Through the year, we have seen increased regulatory attention, wider adoption of BTC as a form of exchange, and broader use of blockchain technology across different sectors.

After an up-and-down 2020, we are now in the New Year, and there is some good news as far as the future of cryptocurrency is concerned. Bitcoin hit $30k on January First, and its value is expected to rise significantly in the coming months.

Bitcoin’s hold up future is bright, and this crypto has become too big to be overlooked by the financial public. Suddenly, people all over the world are talking about the mainstream adoption of BTC and other cryptocurrencies by larger entities at higher price points.

Read more about how many Bitcoins are there in the world right now.

Below are a few predictions for BTC in 2021 and beyond:

Bitcoin Will Close 2021 Above $30,000

Given the run-up that occurred at the end of last year, it can confidently be stated that Bitcoin will close 2021 above $30k.

This might sound like a conservative prediction given that prices don’t always go up, but thanks to the institutional fund flows and interest, it seems this upward trajectory has some support.

Tax Enforcement Will Scale

The mass mainstream adoption of BTC in 2021 and beyond means that tax enforcement will scale. In the US, the IRS made various moves in 2020, which indicated the seriousness with which cryptocurrency tax enforcement will be handled going forward.

With the rump of cryptocurrency prices, expect governments across the globe to take a fresh look at this lucrative potential revenue and create more stringent tax rules.

Bitcoin Will Be Acknowledged As an International Payment Currency

PayPal, the biggest debit payment system, has joined the cryptocurrency market. According to a statement, PayPal says that beginning January 2021, it will allow its users to use cryptocurrency to make payments worldwide without incremental fees.

To address the high volatility associated with cryptocurrency, consumers will be allowed to convert their crypto balance into fiat currency. With over 340 million PayPal users across the globe, it is clear that the mass adoption of bitcoin and other cryptocurrencies is finally here, and this is good news for the crypto future!

Bitcoin Will Serve As a Hedge Against Inflation and Take Up Gold’s Market Share

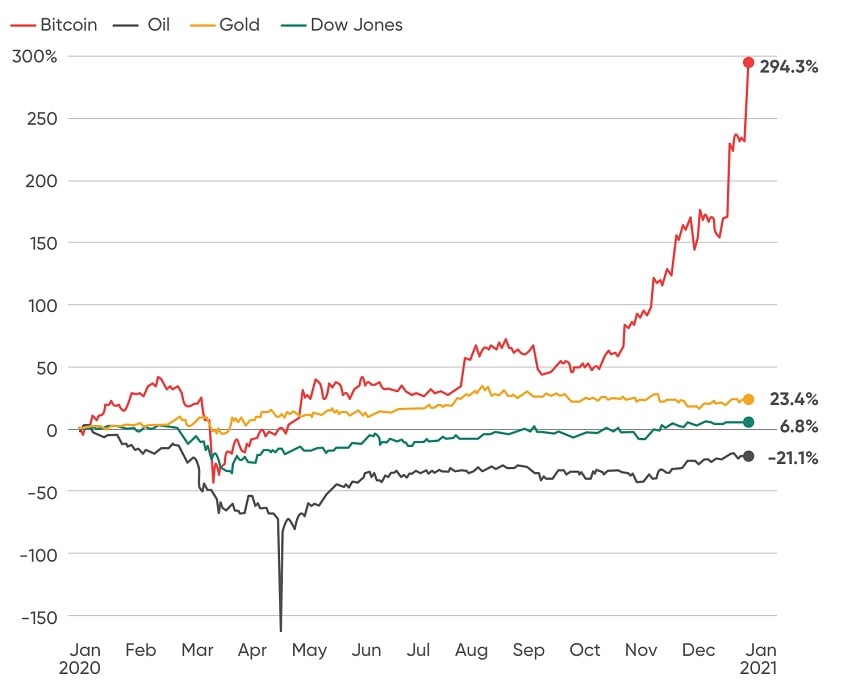

Crypto experts consider BTC a digital alternative to gold, which has been a popular hedge asset for decades. Reports show that by October last year, investment in bitcoin increased exponentially while investments in gold ETF remained almost unchanged.

Today, there is a massive inflow into Bitcoin out of gold, and this trend is expected to continue throughout 2021, according to expert predictions.

In 2021 and beyond, the rise of the crypto market will come at the expense of gold. This sounds natural considering that BTC is a more technologically advanced inflation hedge, while Fiat currency will continue suffering from the consequences of the COVID-19 pandemic.

Blockchain Will Expand Beyond Financial Services

In 2021, BTC’s blockchain may expand beyond financial services. This year will continue with the breakout of trends for crypto assets and blockchain technology in different industries.

Apart from financial services, some of the industries that are expected to benefit include transportation, logistics, education, healthcare, and more.

Cryptocurrencies vs. Coronavirus

The beginning of March 2020 was disastrous for major global markets. When COVID-19 was declared a pandemic, the stock market experienced its fastest and most dramatic fall since 1929. The tourism and hospitality sectors were hit the hardest, and countries across the globe implemented lockdown policies and travel restrictions.

The uncertainty and panic brought by the pandemic led to a liquidity crisis even before an economic crisis set in. Investors hurriedly converted their holdings into cash in a bid to safeguard their finances.

While all this was happening, one of the overarching questions most crypto enthusiasts ask is – did the coronavirus pandemic affect the cryptocurrency market?

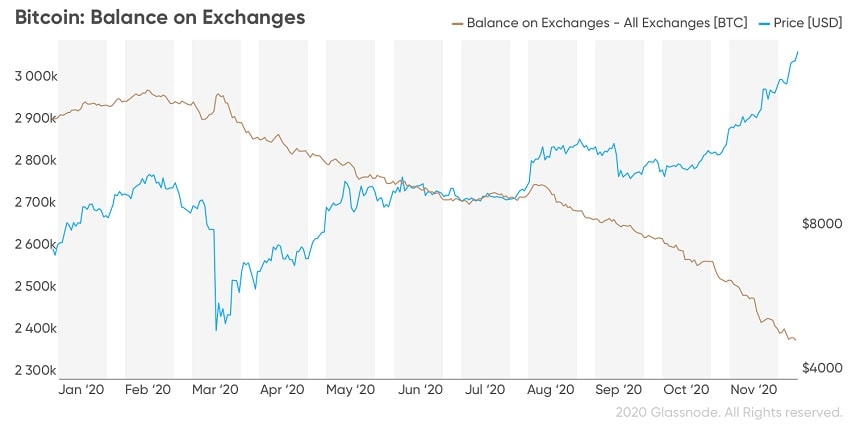

Unfortunately, the cryptocurrency market was not spared either. This pandemic put the future of digital currency at stake, with Bitcoin‘s price falling by half. This major cryptocurrency fell to as low as $3,780 in March. However, this downward trend didn’t last for long. By November 2020, BTC rebounded and almost hit its all-time high.

This quick recovery is a clear testimony of BTC‘s market resilience. This admirable characteristic of digital currency has prompted countries known or their love-hate relationship with cryptos, such as China, to declare it the best asset of 2020 thanks to its stellar performance amidst financial turmoil.

Coronavirus and the Heightened Need for Digital Financial Services

Since March, when news of the coronavirus pandemic hit the airwaves, cryptocurrency started gaining a reputation as a safe haven investment, much like Gold, Platinum, and other valuable metals.

However, this is not the only reason why investors should spice up their investment portfolio with altcoins and Bitcoin. The shock of this pandemic has promoted businesses across the world to accelerate their digital infrastructure that includes tech-enabled financial solutions. Digital currencies have stepped up to fill this need.

Financial institutions are now racing to roll out crypto-based solutions that include withdrawals, payment transfers, and deposits through digital wallets.

Experts also believe that the pandemic has prompted PayPal and other dominant payment gateways to announce support for cryptos that can enable their customers to buy, sell, and hold valuable digital assets.

This is a clear display that shows why the cryptocurrency is the future and a reliable solution to society‘s ever-evolving demands.

Should I Invest In Bitcoin Now?

What is the future of Bitcoin? The reason why most potential crypto investors ask this question is that they want to find out whether investing in Bitcoin is worth it.

Factually, there are many reasons why you need to invest in Bitcoin as soon as now.

Prices Will Keep Growing

One of the biggest benefits of investing in Bitcoin is that its prices will keep growing. Of course, this is a volatile currency, and its value is prone to highs and lows. But with more people than ever using it as a primary currency, its price will keep increasing.

Today, businesses and individuals have realized that BTC and other cryptocurrencies are the ultimate solutions to their problems.

The more people love BTC, the higher the price will shoot in the market. Investing in Bitcoin might not guarantee profits, but you can rest assured you will enjoy them in no time.

Bitcoin Adoption Is Growing At An Alarming Rate!

Global adoption of Bitcoin is growing at insane rates. The number of people holding BTC in their wallets and those buying it through various exchanges keeps growing every day.

If the demand continues to grow, there is no doubt that this will result in more explosive price movements in 2021 and beyond.

BTC Value Proposition Is Suited To the Macro Climate

BTC was born out of a global financial crisis in 2009. It was deployed against a backdrop of back failures, quantitative easing, and government bailouts. It was ignored by many except a few idealists.

Ten years later, we are experiencing a new and unexpected financial crisis with more bailouts, increased quantitative easing, and historically low-interest rates.

COVID-19 is a one-of-a-kind virus that has made companies and individuals realize where BTC and other cryptocurrencies sit in this macro environment.

The world has known that Satoshi Nakamoto created Bitcoin as a possible solution to a financial crisis.

Since BTC‘s protocol has a hardcoded limit of 21 million coins, it creates a unique digital scarcity. When the demand rises, miners cannot increase the supply. The supply can only come from holders who are willing to sell. Bitcoin is, therefore, a valuable asset to own!

Bitcoin Always Surpass Its Previous All-Time High after a Crash and Recovery

When we talk about the future of cryptocurrency, we cannot forget to mention that there is a likelihood that Bitcoin will surpass its all-time high after a price crash and recover. This fact holds true if historical data is anything to go by. BTC has seen various peaks and troughs over the past 10 years.

It has been reported “dead “over 383 times by the mainstream media. Nonetheless, it has somehow managed to surpass its all-time highs, so there is absolutely no reason to believe that the same scenario will not take place again.

In 2011, Bitcoin‘s price hit $30 on Mt.Gox, which was the most popular exchange at that time. A hack followed, and the price dropped to a low of $2 in November the same year before recovering the following year again.

By April 2013, the price of BTC crossed the $260 mark, before falling by over 50% within hours as Mt.Gox was not able to handle the increased trading volumes and was hit by a damaging DDoS attack. This led to a decrease in investor confidence, but seven months later, BTC hit its all-time high.

In late 2013, Bitcoin hit a historical high of $1,000. The price gradually dropped to $175 in 2015 and rose again to $1,000 in 2017. By December 2017, this coin hit a famous all-time high of $20,000 per coin.

Bitcoin is an asymmetric bet, to say the least. As long as you invest what you can afford to lose and use reliable wallets like Tezro, there is a limited risk of loss with the benefit of substantial financial gains.

Find out all about Tezro’s features and why you should choose it as your wallet. Invest wisely!

Cryptocurrencies will be mainstream

Will cryptocurrency last? This is one of the questions you will find in most crypto Q&A platforms. The answer to this question is straightforward – cryptocurrencies will be mainstream.

BTC has hit an all-time high of $30,000, and this has created excitement at both the fear and possibilities of a 2017-style crash. But with big corporations boarding the crypto bandwagon, there is an underlying story of digital currencies that continues to unfold.

Click here to understand the difference between digital currencies and cryptocurrencies.

The Covid-19 pandemic has changed the views of crypto enthusiasts and investors across the globe, forcing some to pitch BTC against gold as a strategic hedge. Could this be the verge of cryptos becoming mainstream?

Bitcoin‘s upward trajectory aside, 2021‘s potential as the year of cryptos is increasing, with PayPal deciding to incorporate cryptocurrencies and Facebook finally planning to roll out its crypto known as Diem (Formerly Libra).

This speaks volumes about cryptocurrency as the much-awaited solution that will fix all problems in the financial ecosystem.

Crypto Loans

Today, there are many financial lenders that offer loans in fiat currency, which are collateralized by crypto assets. This means that they give you USD, and you give them BTC or any other cryptocurrency as security for repayment.

Is It Wise To Take A Crypto Loan?

As a crypto owner, you have a long-term view of your investment. Even though you plan to hold your assets until prices go up, there are times you might be forced to liquefy your coins or fiat currency. Instead of selling, you may consider using these coins as collateral towards a crypto loan.

This allows you to maintain ownership of your funds while gaining access to the fiat currency you need to fund your projects.

You can use crypto loans to:

- Fund a business

- Buy a home

- Pay travel expenses

- Pay off high-cost debts

- Diversify investments

- ..and more!

When applying for crypto loans, make sure you work with reputable institutions so that you don’t end up falling prey to criminals whose main goal is to steal your valuable assets at all costs.

Regulations

Although cryptocurrency has seen a boom since the pandemic hit, its regulation still remains its biggest challenge. Bitcoin is becoming more mainstream, but the problem is that it remains unregulated in most countries.

However, the value of this asset over the past few months has forced most governments across the world to create laws that regulate this market.

A case in point in Singapore. The Monitory Authority of Singapore (MAS) has created a legal framework that makes it easy for businesses and individuals to buy, sell, and hold digital currencies.

Given crypto’s potential to change the financial landscape as we know it, nations of the world need to follow suit and act fast in establishing strict rules and regulations that govern the market.

One thing that COVID-19 has highlighted is that the notion that Bitcoin and altcoins have great value in the real world is not a speculation but a fact!

Key Takeaways

- With the mass adoption of cryptocurrencies, cryptocurrencies could become mainstream.

- Bitcoin has hit its all-time high since 2017 of $30,000, and this upward trajectory is expected to continue in the coming months.

- Crypto loans are readily available but do your due diligence before working with a lender.

Conclusion

The emergence of Bitcoin as a valuable cryptocurrency has sparked a debate about the future of cryptocurrencies.

Despite the ups and downs that BTC has faced over the years, it has kicked off 2021 with an admirable high of $30,000, and it is expected that its value will increase significantly over the next few months.

Big brands are investing heavily in Bitcoin, and this simply means that digital currency could become mainstream before we know it.

A case in point is Mutual Life Insurance, one of the oldest insurance companies in Massachusetts, which has injected $100 million, yes, 100 million bucks into Bitcoin.

If you happen to have some spare time in 2021 (which you should as a shrewd investor), it seems the best way to make respectable gains is by penetrating the crypto market.

Don’t forget to download the Tezro app to make your Bitcoin investments and trades fully safe and encrypted.