Did you know that is there is a huge difference between digital currency Vs. Cryptocurrency? Well, you probably didn’t.

The idea of separating Cryptocurrency and digital currency might sound crazy – even to crypto fanatics and investors, but the fact is that they are different in many ways.

So, where does the confusion between Virtual Currency Vs. Cryptocurrency come from?

More often than not, Cryptocurrency is identified with digital currency.

Even if you type “Cryptocurrency” in your search engine, there are high chances you will find the word “digital currency” or “virtual currency” in all the resources you find.

It’s worth noting that there are fundamental differences between cryptocurrency vs. virtual currency.

To understand these two currencies better, let us discuss each one of them separately.

What Is Digital Currency?

Digital currency definition is straightforward. It is basically the money used to make payments over the internet.

According to a 2015 report by the European Central Bank dubbed “Virtual Currency Schemes – a Further Analysis“, digital currency is defined as the digital representation of value.

This type of currency is not issued by a credit institution, e-money institution, or a central bank. It can be used as an alternative to physical currency.

Even though virtual currency doesn’t have a physical equivalent in the real world, it can be exchanged, sent, or received like fiat money. Simply put, virtual currency has all the characteristics of classic money.

It can be used to pay bills, make utility payments, and pay for goods or services in online stores. What makes them different from physical currencies is that they can be sent and received worldwide in a fast and effective manner.

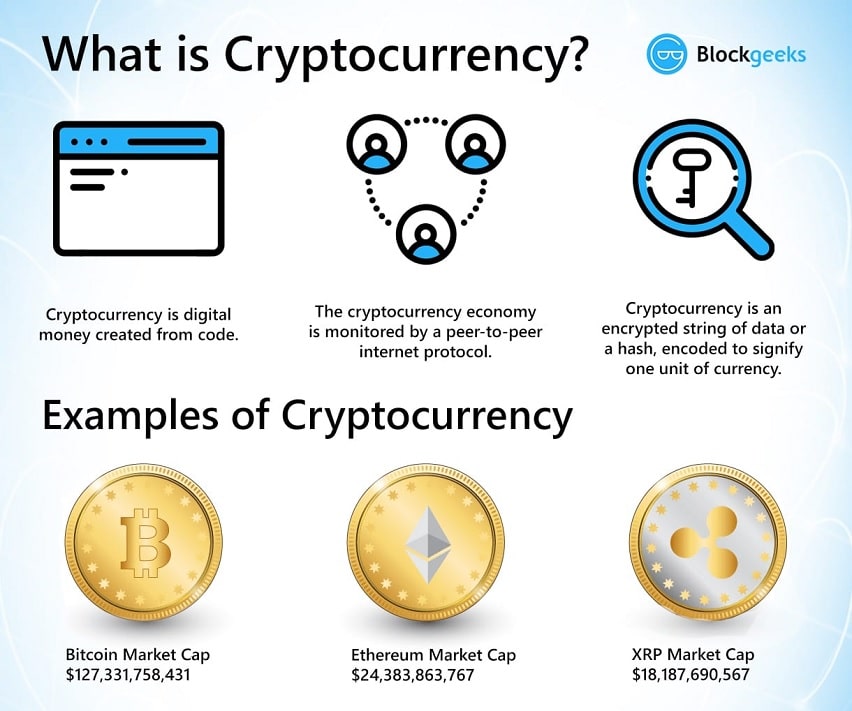

What Are Cryptocurrencies?

As mentioned earlier, there is a rift between digital currency Vs. Cryptocurrency. Interestingly, cryptocurrencies are a specific variant of virtual currencies.

What makes cryptocurrencies different from other digital currencies is that they are algorithm-powered.

They are utilized as tokens in various online communities and are backed by certain tools, assets, projects, or technologies.

Mostly, they are used to make peer-to-peer payments, but thanks to their ever-increasing popularity, they are now used to pay for goods and services in the real world.

Cryptos are hailed as secure, trustworthy, and reliable digital currencies since they are based on cryptography. This is the art of solving and writing complex codes using a mix of mathematics and sciences.

It is extremely difficult to crack these codes; hence it is virtually impossible for anyone to hack and steal coins in a Cryptocurrency network.

Cryptographic protocols are also essential in masking the identity of crypto users – and this makes it difficult to attribute fund flows and transactions to particular individuals or groups.

How many cryptocurrencies are there?

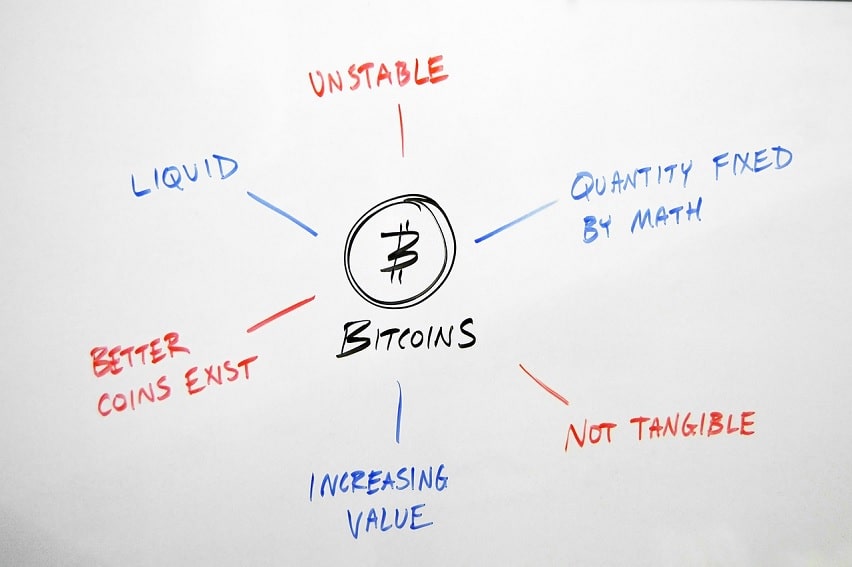

Cryptocurrencies use a decentralized and blockchain ledger, and this means they are not controlled by any authority, individual, or group.

This means that their supply and control are determined by the activities of their users and the complex protocols entrenched in their governing codes and not the conscious decisions of regulatory authorities.

Additionally, major cryptocurrencies such as Bitcoin place a limit on the number of coins that can be in circulation, and this makes cryptos more scarce than gold. This explains why cryptocurrencies are highly valuable assets.

Below are some examples of cryptocurrencies:

- Bitcoin

- Bitcoin Cash

- Litecoin

- Ripple

- Ethereum

- Dogecoin

- …and more!

Digital currencies Vs. Cryptocurrencies – The Differences

Like we said before, despite having some similarities, there are important differences between the two concepts mentioned.

Below are some fundamental differences between e-money Vs. Cryptocurrency.

Anonymity

You cannot transact with digital currencies without identifying yourself. You will need to fill in your personal information and even upload a photo of yourself and some documents issued by the government.

This means that when using digital currencies, it is easy to identify individuals or groups involved in a particular transaction.

Cryptocurrencies, on the other hand, use cryptographic protocols, which are complex code systems that encrypt sensitive information transfers. This secures the units of exchange.

Crypto developers build these protocols using advanced computer engineering and mathematics principles that render them virtually impossible to crack.

They protect the identities of or users, and it could take a lot of time, energy, and resources to find out the people or group of people making transactions.

This means that the Cryptocurrency network provides anonymity that cannot be found in virtual currencies.

Structure

Digital currencies are centralized in nature. Even though they are not provided and controlled by central banks or other institutions, transactions are controlled and regulated by a particular group of people and computers. Let’s take PayPal, for example.

All the money you send or receive through this medium is controlled by the company. PayPal has the right to accept or reject a particular transaction.

Cryptocurrencies are not controlled by a particular group of people or individuals. They are marked by decentralized control. Their value and supply are determined by the activities of their users.

All the regulations are made by the majority of the community using a particular Cryptocurrency.

Transparency

Another huge difference that settles the debate between digital money vs. cryptocurrency is transparency. Virtual currencies are not transparent. It is difficult to select the address of a particular wallet and see all transactions.

This information is confidential and cannot be made public. In Cryptocurrency networks, all transactions and revenue streams are placed in a public chain.

It means that the transactions of any user can be accessed – and this enhances transparency.

But does the transparency nature of Cryptocurrency networks come with privacy issues?

This is one of the questions most newbies in the crypto space ask. Look – you don’t want everyone to see your financial details on a public ledger. It is understandable.

However, you need to remember that cryptocurrencies use cryptographic protocols. This makes everyone being represented by their network pseudonymous.

Meaning that even if your transactions are out there, no one will find out who you are. Your wallet address is what links transactions, but there is absolutely no personal information linked to the address.

Legal aspects

The legal aspects make all the difference between digital currency Vs. Cryptocurrency. Many countries around the world have defined legal frameworks that govern virtual currencies.

For instance, digital currencies in countries in the European Union are governed by the Directive 2009/110/EC. In the United States, they are regulated by Article 4A of the Uniform Commercial Code.

When it comes to cryptocurrencies, the establishment of a legal framework to regulate them is still a work in progress.

Even though some countries such as the US and China have tried to develop regulation, lack of enough regulation in most countries around the world is one of the biggest drawbacks of cryptocurrencies.

Today, there are thousands of black and grey market transactions that have dominated bitcoin and other cryptocurrencies. For example, the infamous Silk Road – a dark web marketplace used bitcoin to facilitate the purchase of illegal drugs and finance other illicit activities.

Even though this marketplace was shut down in 2014, cryptocurrencies are today popular tools that fuel money laundering.

Despite cryptocurrencies being valuable digital assets, you shouldn’t fear investing in, enacting government regulations will be a great step towards chanting a brighter ‘crypto’ future.

Transaction Manipulation

Virtual currencies are centralized in nature, and they have a central authority that deals with issues that may arise in a transaction.

In case a dispute is raised, or fraud or money-laundering is detected, a transaction can be frozen or canceled.

Furthermore, cryptocurrencies are regulated by the community, and it is extremely difficult to make changes to a blockchain.

This means that it is easier to have transaction manipulation in cryptocurrency networks than in digital currencies.

The Strengths and Weaknesses of Digital Currency

Digital currencies ride along with a plethora of benefits. Among those, we can count the following:

Cheap and Instant Worldwide Payments

Credit card payments can sometimes be steep, especially with international use. Fees can range between 2-5%. Users often feel the pain when they end up paying hundreds of bucks to accept payments from clients or customers who are in other countries.

By using digital currency, you pay a much lower fee in every transaction. Sometimes, you don’t incur any fees when making or receiving payments.

Faster Receipt of Funds than Through Regular Banks

When someone makes a payment through direct bank transfer, it could take days or even weeks for the transaction to be completed. With digital coins, transactions are often completed within minutes.

Even though transaction speeds vary depending on the digital currency you are using, it is still much faster than the transaction times of legacy financial institutions.

Provides Avenue for Resolving Disputes

One of the biggest differences between digital currency Vs. Cryptocurrency is that digital currency is centralized. It is controlled by an authority, which is not necessarily government or central bank controlled.

In case a dispute occurs in a transaction or fraud is detected, the authority can freeze the transaction until the underlying issues are fixed.

Convenient

To use digital currency, you don’t have to follow many steps and fill in tens of documents to open an account as physical banks do.

All you need is a device with access to the internet, and you can open a wallet from wherever you are.

Weaknesses of Digital Currency

Security Loopholes

Data Security is a major concern when it comes to digital currencies. Unlike decentralized systems, centralized systems keep a lot of information about their users.

In the case of a data breach happening, this information might be used for malicious intent. Also, the data can be lost or transferred to authorities upon a court request.

Fraud

The fact that digital currency transactions can be canceled comes with its fair share of challenges. Sometimes, you can make a genuine transaction, but the sender may decide to raise a dispute.

The authority in charge of the digital currency medium will put a hold on your money, and if you are unable to prove that the transaction was genuine, you may lose a significant amount of money.

Even though fraud occurs in decentralized systems, it rarely occurs in this manner. This is because sensitive information about investors is not stored in a Cryptocurrency blockchain.

Instead, users only get a unique wallet address. This ensures that their transaction history remains public, but their personal information cannot be accessed in any way.

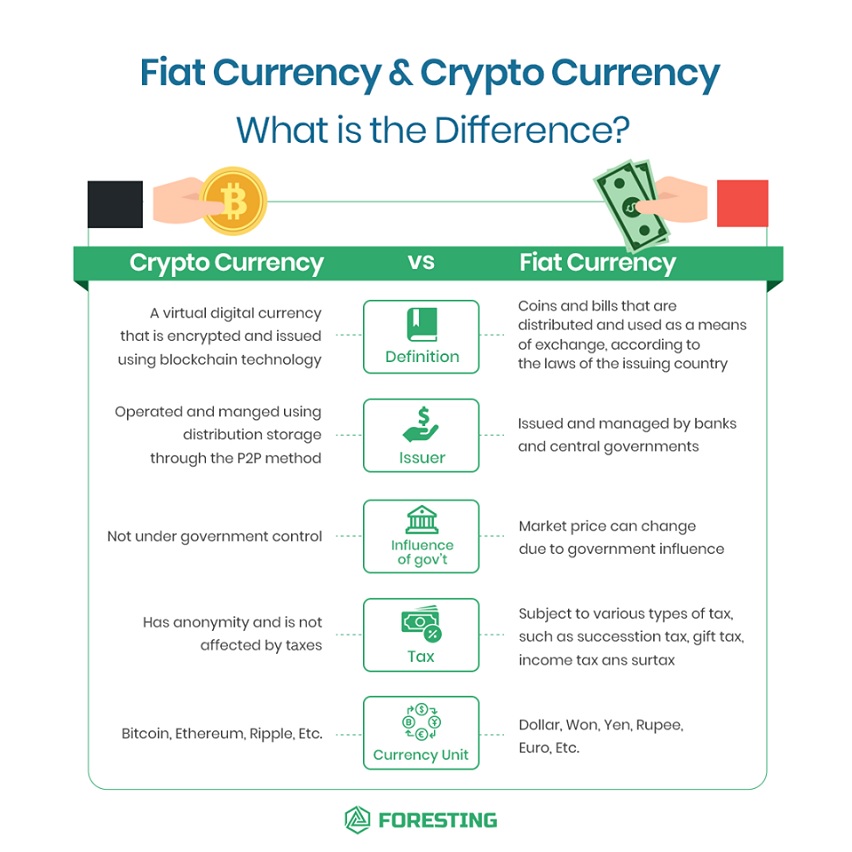

In the end, it all comes down to the old debate Fiat Currency & Cryptocurrency, which we have discussed in a previous article.

Is It Possible To Combine The Benefits Of Both?

Factually, the implementation of centralized systems into decentralized systems could lead to massive success. Look – over two billion people neither have bank access to bank services nor have bank accounts. There are also over 5 billion people who use mobile communications.

If banking systems are incorporated into mobile networks, the number of bank customers will increase significantly.

Blockchain and Cryptocurrency will provide exceptional transparency and security through decentralization, while digital money will provide a governing body that will offer well-laid-out regulation.

A good example of how to combine the benefits of digital currency and Cryptocurrency is being realized by Telcoin.

The main idea behind Telcoin is to combine mobile companies across the globe with the banking system.

This banking system is represented by the symbiosis of virtual currency and a novice cryptocurrency that will offer a myriad of services, including postpaid billing platforms, mobile money, prepaid credit card, and more.

Key Takeaways

- Cryptocurrency and digital currency are two terms that have been used together for years, although they are different in many aspects.

- Digital currency is a blanket term used to refer to money that exists in the online space. Cryptocurrencies and virtual currencies are digital currencies because they exist in the virtual world.

- It is possible to combine the benefits of Digital Currency Vs. Cryptocurrency to increase the number of bank users while enhancing Cryptocurrency acceptance.

Conclusion

The differences between digital currency Vs. Cryptocurrency has been ignored for years since most people believe they have the same meaning.

The main difference between the two is that digital currencies are centralized, which means transactions within the network are regulated by a group of individuals in a centralized location.

Cryptocurrencies are decentralized, and all the regulations within the network are made by the majority of the community.

Even though cryptocurrencies are a variant of virtual currencies, these two terms should not be used as synonyms.

Before you get into the world of Cryptocurrency, it is important to understand the nuances between these two terms that have been combed together for years.

Whenever you feel confused, refer to this article. And don’t forget to download Tezro, an entirely encrypted text message app that allows you to exchange your crypto assets with total commodity.

Read more about the complete list of features that Tezro can offer you.