What is DEX? Well, this is a question that many people in the crypto sphere have been asking lately thanks to the growing popularity of decentralized exchanges.

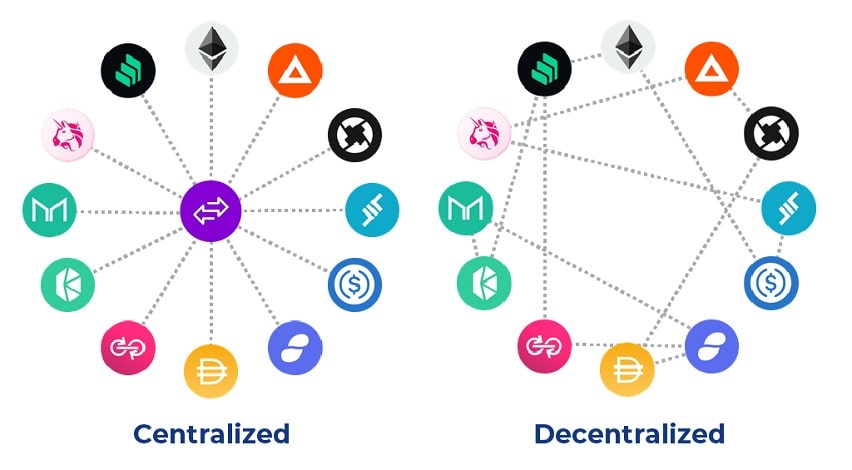

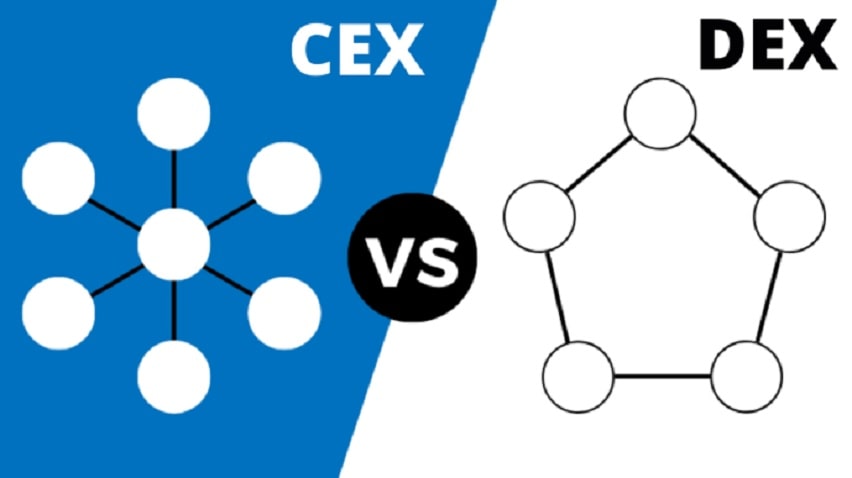

A decentralized exchange is an exchange that is not controlled by any single entity. Instead, it is controlled by the users of the exchange. This makes them more secure than traditional centralized exchanges, which are vulnerable to hacks.

DEXs were created for the sole purpose of decentralizing cryptocurrency trades. They are built on a blockchain and do not require any third parties to facilitate transactions between buyers and sellers. They allow peer-to-peer trading which means that users can trade directly with each other without going through an intermediary.

In this article, we are going to look at DEXs in more detail, how they work, the advantages and disadvantages, as well as some of the most popular DEXs. Read on!

What is DEX?

A decentralized exchange is a cryptocurrency exchange that is built on a blockchain and allows users to trade cryptocurrencies without needing an intermediary.

DEXs are different from centralized exchanges because they do not store your funds in their own wallets, but instead, use smart contracts which facilitate the transactions between buyers and sellers directly.

These exchanges are built on top of layer-one protocols, which means that trades are conducted through wallets instead of a platform. This makes the transactions more secure because no one is holding your funds except for you, and it also makes DEXs cheaper to use since there are fewer fees involved with these exchanges

There are different types of decentralized exchanges including the following ones:

Automated Market Makers (AMMs)

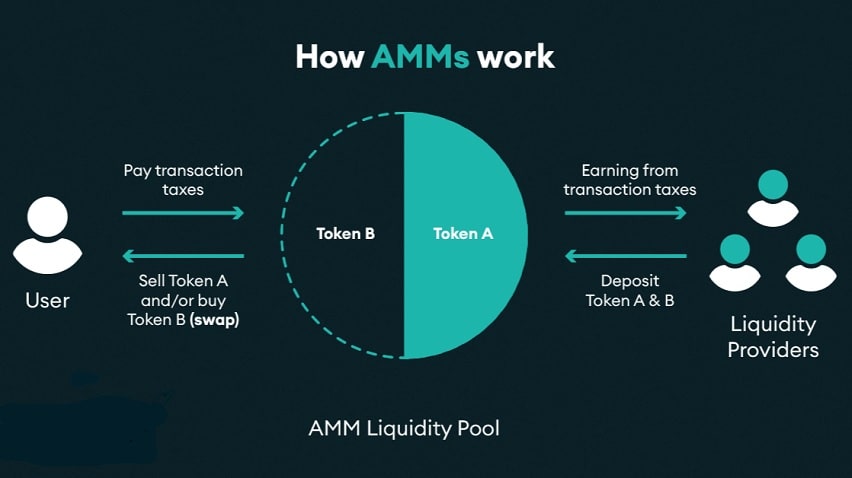

AMMs are exchanges that allow users to buy and sell cryptocurrencies without needing to find a counterparty.

They work by matching buyers and sellers automatically through an order book. This makes it easier for people to trade cryptocurrencies since they don’t need to worry about finding a buyer or seller themselves.

These exchanges usually have low fees and offer a wide range of cryptocurrencies to choose from. However, they can be quite slow due to the large number of orders that need to be processed.

DEX Aggregators

DEX aggregators are similar to AMMs, but they allow you to trade with other users on the exchange instead of automating the process. This makes DEX aggregators faster than AMMs, but they usually have higher fees. They also offer a wider range of cryptocurrencies than AMMs.

Order Book DEXs

These exchanges are similar to aggregators, but they allow users to trade with each other through an order book.

This makes them faster and cheaper than aggregators, but they usually don’t have as many cryptocurrencies available for trading.

History of Decentralized Exchanges

When Bitcoin was first created, there was no way to trade it directly for other cryptocurrencies. In order to do this, you needed to go through centralized exchanges. These exchanges were vulnerable to hacks and were often used to scam users out of their money. Hackers found them easy targets because they stored all of the user’s funds in their own wallets.

On 3rd January 2014, NXT announced the first decentralized exchange on their forum. It allowed users to trade Bitcoin directly for NXT. The NXT ecosystem was fueled by its own token, so users needed to buy NXT in order to use the exchange. This made it difficult for the asset to asset trades to take place effectively; hence, the DEX did not gain much popularity.

Another drawback of this DEX was that coins could only be sent to wallets that supported the Open Assets Protocol. This meant that users needed to create a new wallet for every cryptocurrency that they wanted to trade.

Around the same time, Counterparty launched a DEX known as the XCP DEX. This exchange allowed users to trade Bitcoin directly for Counterparty tokens. The counterparty token was used to pay trading fees and enabled asset creation. This DEX was more successful than the NXT DEX because it had a wider range of cryptocurrencies available for trading. However, it was still difficult for users to use due to the lack of support from other cryptocurrencies.

What To Expect From DEXs in the future?

The beginning of 2015 saw the invention of a truly decentralized exchange – Block DX. This DEX was built on top of the Blocknet Protocol, making it the first DEX to be built on top of a second layer blockchain interoperability protocol. It allowed users to trade Bitcoin directly for different cryptocurrencies, including coins that were not supported by any other exchange at the time.

It worked by having users broadcast their orders through a pneumatic tube system. This meant that there was no central point of failure and that the exchange could not be shut down by anyone.

The next evolution of DEXs came in the form of relayers. Relayers are decentralized exchanges that allow users to trade tokens without needing to deposit them into an exchange. They work by matching buyers and sellers through an order book and then depositing the tokens into a smart contract when the trade is complete. This makes it easier for users to trade since they don’t need to place their tokens in a smart contract before they trade.

Today, the most popular DEXs are built on the Ethereum blockchain. This is because the Ethereum blockchain has been designed to be more scalable than Bitcoin, making it better suited for decentralized exchanges.

How does DEX work?

Now that you know what is DEX in cryptocurrency, let’s take a look at how it works.

DEXs work by matching buyers and sellers through a smart contract. The coins are then deposited into the smart contract until the trade is complete.

Once the trade has been completed, funds are released to both parties and any profits or losses are recorded on both sides of the transaction. This allows users to trade without having to put their money in an exchange wallet where it could be lost due to a hack.

In order to use DEX, you need to have an Ethereum wallet in which you can store your coins. You then place orders that match your buying or selling price on the exchange’s order book. If there are any matching offers on the order book, those will be matched and executed automatically by the smart contract.

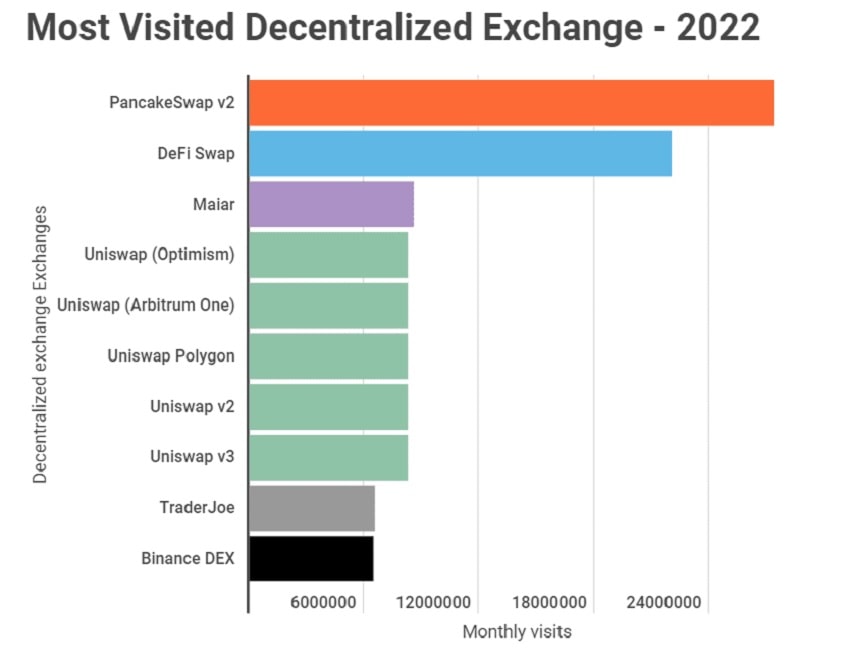

The most popular DEXs include:

- AirSwap (AST)

- PancakeSwap (CAKE)

- Curve (CRV)

- Uniswap (UNI)

- Balancer (BAL)

- Bancor (BNT)

- SushiSwap (SUSHI)

Advantages of DEXs

We cannot learn what is decentralized cryptocurrency without looking at the benefits that come with DEXs. Some of the top advantages include:

- Security: DEXs are more secure than centralized exchanges because they are not as vulnerable to hacks.

- Liquidity: DEXs have better liquidity than centralized exchanges because there is no central point of failure. This means that orders can be filled quickly and easily.

- Fees: Fees on DEXs are usually much lower than fees on centralized exchanges.

- Ease of use: DEXs are usually much easier to use than centralized exchanges. This is because there is no need to deposit coins into an exchange wallet before you can start trading.

- Reliability: DEXs are more reliable than centralized exchanges because they are not as reliant on a single point of failure.

- Control over your funds: With a DEX, you are in control of your funds at all times. This is because you are not reliant on a third party to hold or trade your coins for you.

- Privacy: DEXs offer more privacy than centralized exchanges because they do not require you to submit any personal information when you sign up. Also, all orders are executed through a smart contract and are not stored on any server.

- Financial inclusiveness: DEXs are available to anyone with an internet connection and a crypto wallet.

Disadvantages of DEXs

There are some disadvantages that come with using a DEX, including these below:

- Suspense over Ownership: One of the main disadvantages of DEXs is that it is not always clear who owns the tokens that are being traded. This is because all trades are executed through a smart contract and there is no central authority to track ownership.

- Low Trading Volume: Another disadvantage of DEXs is that they often have low trading volumes. This is because they rely on users to place orders manually rather than automatically through an order book.

- Not Beginner Friendly: DEXs can be difficult for beginners to use. This is because there is a lot of terminologies that need to be learned in order to trade correctly.

Key Takeaways

- DEX is an exchange that is not controlled by any single entity;

- They were created for the sole purpose of decentralizing cryptocurrency trades;

- Compared to centralized exchanges, DEXs offer more security, liquidity, privacy, and lower fees.

- The cons of these exchanges are a non-beginner-friendly interface, a low trading volume, and a lack of transparency in the ownership of the tokens.

Final Thoughts

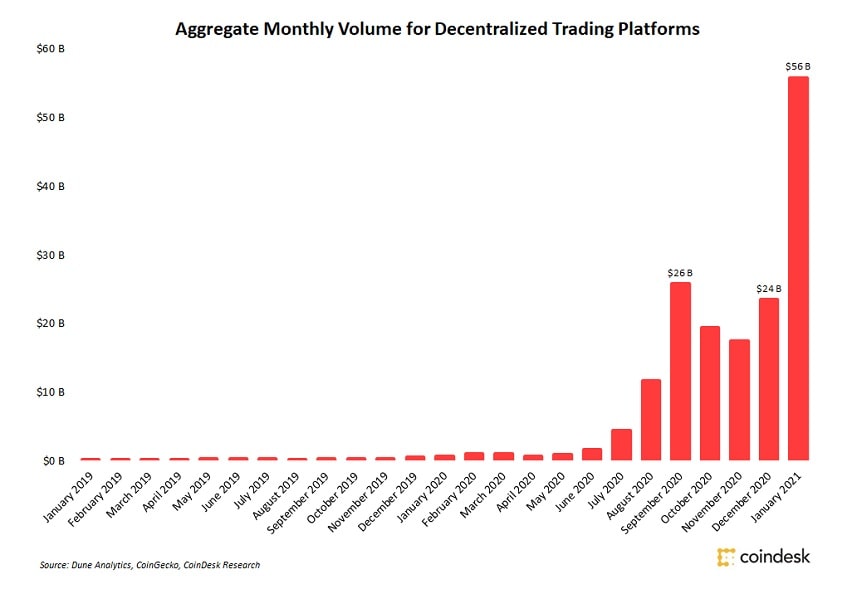

Decentralized exchanges are becoming more and more popular. This is because people are becoming more aware of the security and reliability benefits they offer over centralized exchanges.

It’s wise to speculate that the future of cryptocurrency will likely involve more decentralized exchanges and less centralized ones. Despite the fact that there is less public awareness of DEXs, they are slowly gaining traction as the go-to choice for traders.

As you seek to understand what is DEX and how it works, keep in mind the advantages and disadvantages that come with using this type of exchange. You can also download Tezro app and find another different way of storing and trading your crypto assets.

Weigh the pros and cons carefully before you decide whether or not a DEX is a right choice for you. Then, find a safe, reputable DEX that has all of the features you need to successfully trade your favorite coins.