The history of cryptocurrency is an interesting one. There are people who believe that the idea of cryptocurrency was first introduced in 2009 when Bitcoin came to be.

However, there are those who believe that the idea of having a decentralized currency started way beyond 2009, and they are right!

Prior to the creation of Bitcoin, there were numerous attempts at creating cryptocurrencies.

The reason why most, if not all, didn’t succeed was mainly because of double-spending. A digital asset needs to be used only once to prevent copying and counterfeiting.

With these in mind, you might need answers to questions such as: what was the first decentralized currency? How old is crypto? When did crypto start? Was Bitcoin really the first cryptocurrency? What year did cryptocurrency start?

When was decentralized cryptocurrency created? What is the concept of cryptocurrency? Was 2009 the beginning of cryptocurrency? Well, to get the ultimate answers to these questions, read on!

How Is Cryptocurrency Made?

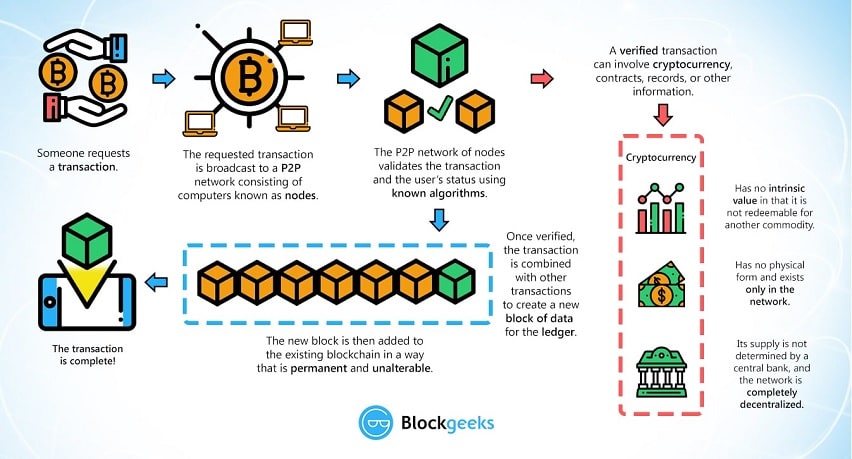

To understand the history of cryptocurrency, it is critical to know how it is made in the first place. Basically, cryptocurrency is created by code. In most cases, new coins are created when transactions are verified and confirmed through a process known as mining.

However, while major coins such as Bitcoin and Ethereum are created through mining, not all coins are created through this complex process. How exactly a coin is created largely depends on what is defined by a given cryptocurrency code.

For instance, some cryptos put out tokens as dividends within a particular period of time or create some tokens upon launch as developer rewards.

In order to comprehend the crypto background and how it is made, there are few points you need to consider.

Cryptocurrency is software

All functions, including how data is stored and how transactions are recorded, are dictated by code.

Blockchain is the main technology behind cryptocurrency transactions

This is especially true for those cryptos that are used as money. Other cryptocurrencies use other unique technologies, but the gist is not different!

Cryptos are created by an algorithm that relies on cryptography

This is the main reason why it is called ‘cryptocurrency.’ All transactions relate back to a unique set of cryptographic codes that make the network insanely secure.

Cryptocurrency software is decentralized and distributed

This simply means that the software is hosted on multiple PCs across the globe instead of a server controlled by a central authority.

Crypto algorithms are created to reward coins to those who add transactions to the blockchain

Those who add coins to the network, popularly known as miners, are rewarded with coins once they confirm transactions on the network.

Another thing worth mentioning is that most cryptocurrencies, especially those used as money, are created by people across timelines running hardware that add transactions to the blockchain network.

Or newer cryptos that use unique technology, tokens are developed by a host of mechanisms based on a cryptocurrency’s software. Also, the code for almost all decentralized digital currencies is public, meaning anyone, including you, can check how coins and tokens are created.

Note: Since the inflation and supply of a cryptocurrency are defined by code, people within a network know upfront whether the coin is inflationary or deflationary.

The only way this can be changed is by changing the software. To do this, a majority of computers running a particular crypto’s software have to agree on the upgrade. In many cases, a change in the rate of supply or inflation would result in a ‘fork,’ which is a newer version of the software.

However, it is highly unlikely the supply of issuance of major cryptocurrencies such as Bitcoin will ever be changed. This gives investors and crypto enthusiasts that this cryptocurrency will remain scarce and will never lose its value.

When Did Cryptocurrency Start?

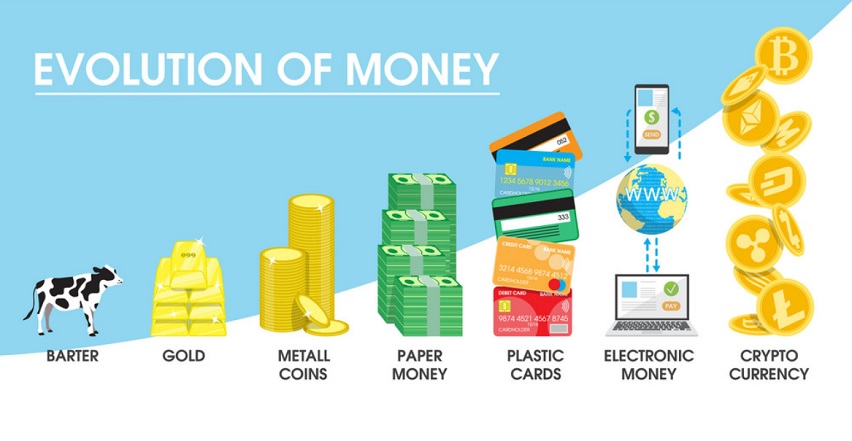

As mentioned earlier, cryptocurrency has a rich and interesting history. In the 1980s, many innovators and developers had the idea of creating a currency that would exist in the digital realm.

These people didn’t get far with their innovations, but they are highly regarded as the individuals who planted the seed for the future and set the pace for those who created digital currencies as we know them today.

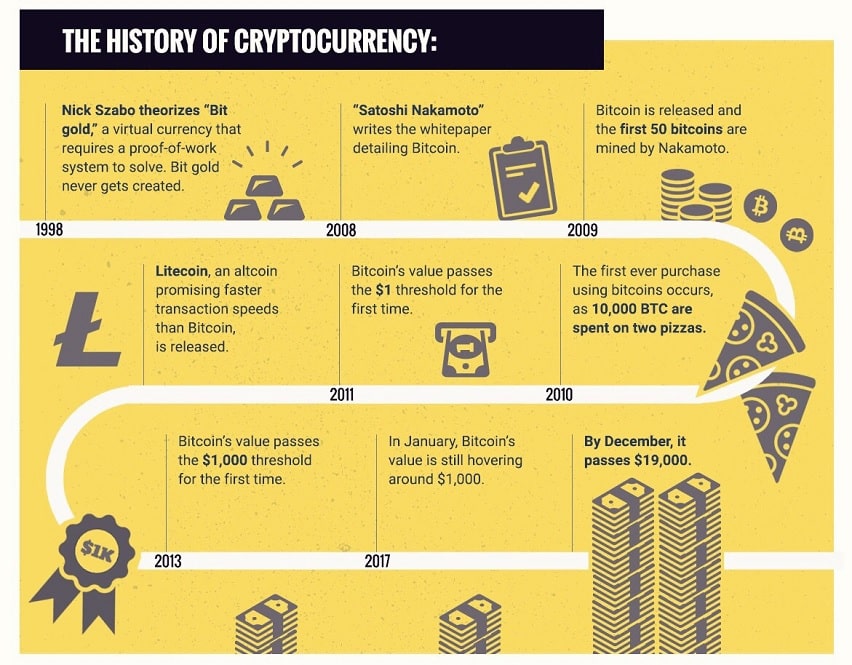

These ideas were taken up by the innovators and developers of the 1990s. In 1998, about 10 years before the introduction of Bitcoin, a computer engineer known as Wei Dai published a paper where he discussed what he called “B-Money.” he discussed in depth the idea of digital money, which could be sent easily along with a group of untraceable digital pseudonyms.

In the same year, blockchain pioneer Nick Szabo drafted another attempt. He looked into developing a decentralized digital currency. His idea was inspired by inefficiencies within the conventional money system, such as reducing the amount of trust required to do a transaction and eliminating the need for metals to create coins.

The early innovators wanted to come up with anonymous payment systems that would be verified and confirmed over a widespread network through a cryptographic process. For some reason, however, none of them gained popularity as a piece of writing that was issued in 2008.

Introduction of the First Cryptocurrency

In 2008, an anonymous person (or people) named Satoshi Nakamoto wrote a technical whitepaper explaining a science project. The paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” during this time, another person registered the domain bitcoin.org.

Nakamoto then published software that allowed Bitcoin to be mined for the first time. On January 3, 2009, 30,000 lines of code spell out the beginning of the biggest cryptocurrency we know today – Bitcoin.

What is a Bitcoin? Read more here.

Why Did Satoshi Nakamoto Create Bitcoin?

In his/their whitepaper, Nakamoto expressed his dissatisfaction that banks and central banks had repeatedly breached the trust of those who deposit money with them by lending money in credit bubbles while keeping too little as a reserve.

Most economy experts believe that Satoshi created Bitcoin to fix the economic meltdown in 2008.

What is a Satoshi and how many Satoshis are in a Bitcoin?

Who Is Satoshi Nakamoto?

The identity of Satoshi Nakamoto remains a closely-guarded secret. Over the years, there have been efforts to uncover who this person is.

Some crypto experts suggest that this is a pen name representing a group of developers.

A man named Dorian Nakamoto was credited by Newsweek as being the Bitcoin creator, but he has later denied that claiming he has “nothing to do with it”.

The Start of Bitcoin

A few months after floating the idea of Bitcoin, Satoshi created 50 BTC with the first transaction on the blockchain on January 3, 2009, at 18:15:05 hours. The system is made such that these initial coins cannot be used or spent.

This initial transaction had an embedded message and a timestamp that indicated Nakamoto’s intention to make BTC live. This message read, “The Times 03/Jan/2009 Chancellor on brink second bailout or banks.”

This message was a reference to a headline of a news article that appeared on that day in The Times in the UK that discussed a second bailout for banks.

Bitcoin began to attract some attention in different online communities, and it began throwing financial institutions out of the picture. It was a peer-to-peer method of payment among parties and operated over a decentralized network – something that had never been seen before.

BTC also redefined the cryptographic process that had been in place in earlier digital currency attempts and made it a reality.

In this revolutionary invention, a network of computers worked together at verifying transactions made between parties. This process eliminated cases of double-spend that were rampant in early attempts.

Read more: How many Bitcoins are there in the world right now?

Bitcoin’s Transactions and Development

We cannot talk about the history of cryptocurrency and fail to mention the first Bitcoin transaction.

According to multiple reports, the first BTC transaction took place when someone paid another 10,000 BTC for pizza. During this time, the coins had no value. In no time, this cryptocurrency started to gain value and occasionally lost it due to the principle of supply and demand.

Considering that Nakamoto had capped the coins’ supply in his paper, their demand would have an impact on the value in a volatile way.

Bitcoin has remained the most sought-after and lucrative digital currency since the publication of the white paper in 2008. Nonetheless, the road to this coin’s success has been bumpy, and in many ways, BTC still has a long way to go to become a viable payment system.

The Rise of ICOs

If you have a background in cryptocurrency, you have probably heard about ICO. ICOs (Initial Coin Offerings), also known as token sales, are a form of crowdfunding for launching new companies and development projects.

Here, developers and entrepreneurs reach out to investors and institutions interested in funding the project.

Investors pony up Bitcoin, Ether, and any other cryptocurrency. In return, they receive digital tokens.

The money raised is used to fund the development of a new blockchain project such as a cryptocurrency exchange or cloud storage.

Or the most part, ICOs are unregulated. They are increasingly used by startups as a way of circumventing the well-laid-out capital-raising processes required by banks and venture capitalists.

The increased reliance on ICOs is causing concern around the world. The Securities and Exchange Commission in the US argues that some questions surrounding ICOs remain unanswered, including whether or not ICOs should be considered securities.

In 2017, this commission published a report stating that some digital tokens can be regarded as securities and would be subject to particular investor registration and disclosure requirements.

Why ICOs were subject to criticism?

Most ICOs lack investor protection, and this is a major cause of concern. Some jurisdictions around the world have moved ahead to label ICOs as scams. For instance, in 2017, the People’s Bank of China denounced ICOs and referred to them as “Illegal fundraising.”

They were consequently banned, and this caused the value of BTC and other major cryptocurrencies to fall. The European Securities and Markets Authority described ICO as a “very risky and highly speculative investment.”

South Korea has also placed a ban on ICOs, with other countries expected to follow suit in the coming years.

The criticism of ICOs doesn’t mean that they are evil. In fact, in 2017 alone, proceeds from ICO exceeded $5 billion, with the top 10 largest projects raising 25% of this amount. Additionally, tokens bought in ICOs gave an ROI of 12.8 times on the initial investment in dollar terms.

We cannot shun away from the fact that ICOs are rife with scam and fraud artists who target poorly informed and overzealous investors. But this doesn’t mean it’s an evil thing.

As long as ICO issuers undergo increased scrutiny and meet higher regulatory standards, ICO will go a long way in shaping the future of BTC and other cryptocurrencies.

2017 – Bitcoin Reaches $10,000

In 2017, the prices of cryptocurrency shocked the world. For the first time ever, Bitcoin hit its all-time high of $10,000! This was spurred by the increased public awareness of its amazing benefits as well as its overall popularity.

Many investors rushed to buy this crypto even though many of them didn’t know what it was all about.

This upsurge in BTC price came with a lot of backlashes. Regulatory authorities started coming up with laws, and governments started monitoring the coins. What followed was a major crash, and Bitcoin’s price dropped considerably.

However, it regained its value in no time. Today, one Bitcoin is equal to $30,000, and this means that Bitcoin is the undisputed leader in the cryptocurrency world.

What is the future of Bitcoin? We anticipate it for you.

Key Takeaways

- The idea of cryptocurrencies was born in the 1980s, but the early innovators did not go far because of issues such as double-spending.

- Bitcoin originated in 2008, and the first transaction took place in 2009.

- The identity of the person/people behind Bitcoin is not known.

- Cryptocurrencies exist online, and there is no physical form of Bitcoin or any other digital currency.

Conclusion

The history of cryptocurrency is an interesting one. The dream of decentralized digital currency was born in the 1980s but was only realized in 2009. The creation of Bitcoin led to the development of thousands of other cryptocurrencies that we know today.

Thanks to their ever-increasing value and mass adoption, there is no doubt that cryptocurrency is the future of the financial ecosystem. Of course, this might sound like a hasty judgment considering that they have been in existence for only one decade.

However, the entrance of giant companies like PayPal and Facebook into the crypto space and the introduction of Central Bank Digital Currency (CBDC) gives us an idea of where cryptocurrency is headed going forward.

No matter what the future holds for cryptocurrency, one thing is for sure: you can trust Tezro app for your crypto exchanges and for a fully safe and encrypted environment. Download it now!