How does cryptocurrency gain value? This is one of the overarching questions that most, if not all, digital currency fanatics ask themselves. To answer this question, you first need to know that cryptos are volatile.

Often, we get news about their highs and lows – and this gives the impression that they are tricky assets to deal with.

However, investing in them is highly lucrative if you understand what causes cryptocurrencies to rise and fall.

This comprehensive piece sums up how cryptos gain value and the key determinants of their ever-changing prices. Read on!

Fiat Currency vs. Cryptocurrency

Today the way we spend money has evolved significantly. Only 8% of the money in the world is represented in physical notes – which simply means that the globe is swiftly progressing towards a cashless economy.

Experts believe that in the near future, fiat currency will be wiped out and will be replaced by digital currencies. Nonetheless, there is still a big debate between fiat currencies vs. cryptocurrency.

Over the past few years, there has been a heated debate on the differences between fiat currency and cryptocurrency. There are some who argue that cryptocurrency is fiat money in digital form, while others say cryptocurrency is the future and will soon wipe out traditional banknotes completely.

To understand these two currencies, let us look at what they are.

Fiat Currency

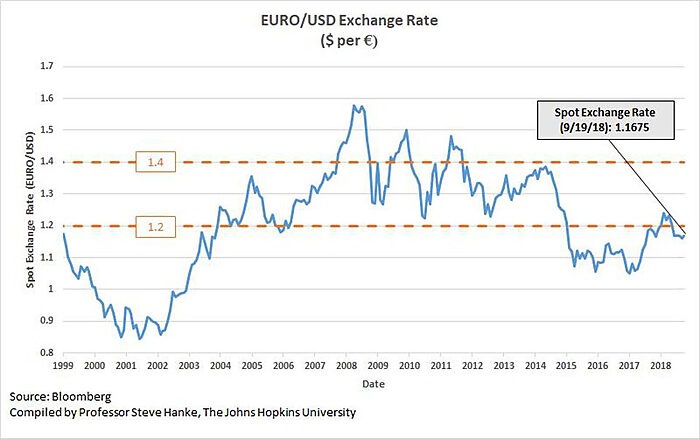

A type of currency given by the government, fiat money is regulated by a central body such as the central bank. Fiat currencies act as legal tender and are based on the credit of the economy. Examples of fiat currency include the US dollar, Euro, and pound.

These currencies derive their value from the market forces of supply and demand. They are not in any way linked to physical reserves such as commodities, and this places them at a high risk of becoming worthless due to hyperinflation.

Cryptocurrency

A cryptocurrency is basically a form of virtual or digital currency that often works as a medium of exchange. Since they are not physical in nature, they utilize cryptography technology to process, verify, and secure all transactions.

Unlike fiat money, digital currencies are not offered by the government and are not controlled by a central authority.

Rather, they are based on limited entries in databases such as blockchain, which cannot be altered or manipulated unless certain conditions are fulfilled.

What are the Main Differences Between Fiat Currency and Cryptocurrency?

Truthfully, fiat currency and cryptocurrency differ in their definitions.

They also have a myriad of other differences, which we list below.

1. Divisibility

Divisibility is an essential aspect of any currency, whether fiat, commodity or cryptocurrency.

Look – if you want to exchange goods across varying values, you must use a currency that can be broken into multiple small units.

Similar to the way fiat currency can be divided into smaller units such as cents, cryptocurrencies can also be broken down to make it feasible for micropayments.

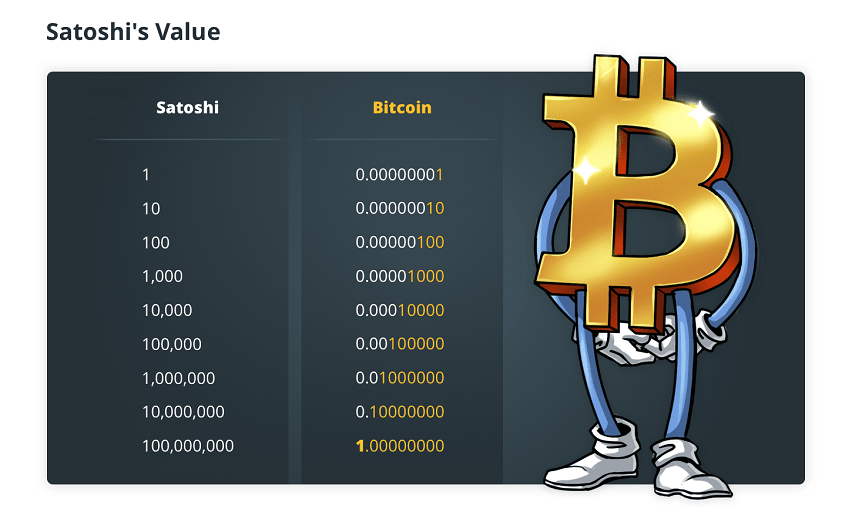

For instance, one Euro can be divided into 100 euro cents. Similarly, bitcoin –which is the largest digital currency by market cap can be divided into 0.00000001 BTC.

The smallest Bitcoin unit is known as Satoshi. One Bitcoin can be broken down into 100,000,000 satoshis.

Just like Bitcoin, other digital currencies can be broken down into smaller units.

The main difference between fiat currency and cryptocurrency in terms of divisibility is that the latter have a two-decimal precision, meaning it has larger divisibility than the former.

2. Counterfeitability

In order for any currency to remain effective, it must be difficult to counterfeit.

If a currency is easy to counterfeit, it allows malicious parties to thrive by flooding the economy with fake bills. This has an adverse effect on the currency’s value.

Due to its complex, decentralized blockchain ledger system and other technologies used by different cryptocurrencies, it is virtually impossible to counterfeit them.

Counterfeiting digital currency would require one to manipulate the entire system and confuse all participants in a network, which is not a small feat.

Meanwhile, Counterfeiting fiat currency doesn’t require an overwhelming amount of effort, resources, and computing power. This makes digital currencies a safer alternative.

Credits: NBC12.com

3. Utility

One of the selling points of digital currencies is the use of blockchain technology.

This is a distributed ledger system that is trustless and decentralized, which means those participating in the crypto market must establish trust in each other for the system to work.

The system is highly flexible, and it makes cryptocurrencies have utility outside the digital currency space.

4. Durability

Durability is one of the key differences between cryptocurrency and fiat currencies. A dollar or euro bill in its physical form can be, for some reason, rendered unusable if it’s torn, burnt, or destroyed, for example.

Digital currencies are not prone to any form of physical damage. This is what makes cryptocurrencies valuable. Nonetheless, this doesn’t mean that digital currencies cannot be lost.

If, for instance, you own some bitcoins and you lose your cryptographic key, the coins in the corresponding wallet can be rendered unusable. This does not mean that the bitcoins will be destroyed. They will still reflect on the blockchain’s records.

5. Transportability

Wallets, cryptocurrency exchanges, and a host of other tools and technologies make cryptocurrencies easily transferrable from one party to another within minutes or even seconds.

Transaction costs in the crypto world are extremely low, regardless of the size of the transaction.

Transferability is one of the most critical aspects that differentiates fiat currency vs. cryptocurrency.

6. Scarcity

Fiat currencies are overtaken by cryptocurrencies in terms of scarcity. Governments are allowed to create as much money as they need at any time.

Even though you might be tempted to treat this as an advantage, it is an aspect that devalues this currency. With cryptocurrencies, there is a defined number of coins that can be put into circulation.

The number of bitcoins that can be put into circulation, for instance, is 21 million.

This limitation guarantees digital currency users that 1 BTC in 2020 will be worth 1 BTC in 2050. Since there is no limitation on fiat currency, 1 US dollar in 2020 will not be worth 1 US dollar in 2050.

7. Inflation of Fiat Currency

Cryptocurrencies are a virtual medium of exchange between two or more parties. They permit direct transactions between parties without the influence or intervention from an intermediary such as a financial institution.

Something worth noting is that there is a limit placed on cryptocurrencies, which means they cannot be over-mined. This reduces the chances of inflation.

For fiat currency, a government may decide to print more currency, and this results in inflation. In case a government chooses to print too much currency, this can result in hyperinflation.

What Causes Fluctuations in Price of Cryptocurrency?

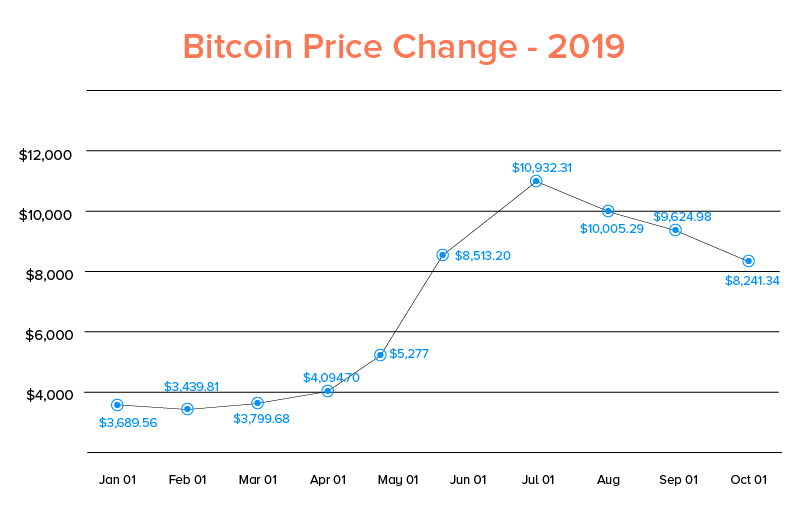

To answer the question of how does cryptocurrency has value, we need to first understand why cryptocurrencies fluctuate. When it comes to cryptocurrencies, prices can change drastically within a short time.

The price fluctuation in digital currencies is quite rampant and occurs due to a number of factors.

1. The Perceived Value

One of the main reasons why cryptocurrencies see a huge change in their prices is because of the store value they are perceived to have over fiat currencies.

When we look at the differences between fiat currencies vs. cryptocurrencies, we find that fiat currencies are controlled by governments.

These authorities seek to maintain high employment levels and keep inflation levels low. This simply means that the economies built with Fiat currencies can either be strong or weak.

When it comes to cryptocurrencies, people are motivated to invest more or less based on how much value they feel the digital currency has. Therefore, perceived value is what affects cryptocurrency prices.

2. Bad Press and Poor Adoption Rates

Even though Bitcoin and other cryptocurrencies have gained massive popularity around the world thanks to their decentralized nature, there are some mal practitioners who have maligned their good reputation.

The press also instills fear in people, and this has caused a shift in the value of cryptocurrencies.

3. High Profile Losses

How does cryptocurrency value increase? Well, the value of cryptocurrencies increases when high profile profits are recorded.

Though, when high-profile losses are made, prices fluctuate, and adoption rates decrease.

The losses that investors make and the subsequent news about them increases the effect of the volatility in crypto prices.

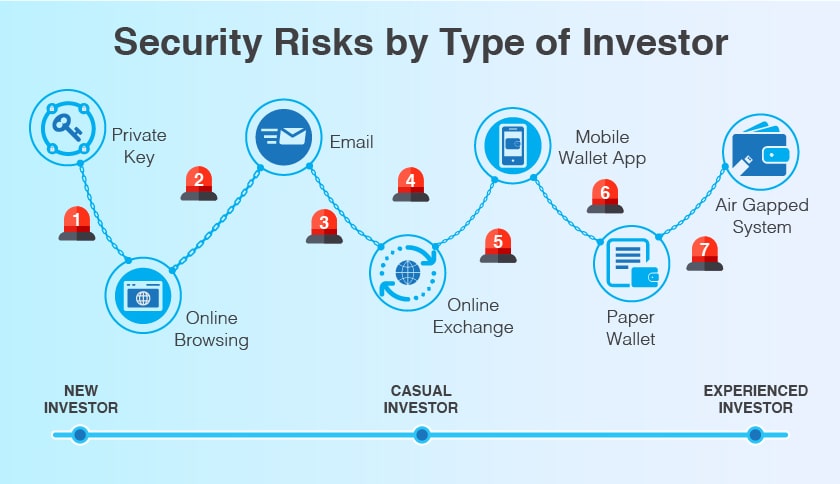

4. Security Breaches

When you ask crypto enthusiasts questions like “why do cryptocurrencies have value?” they will be quick to answer that cryptocurrencies are highly secure.

However, there are many instances when some people have pointed out vulnerability issues in some networks, and this has led to massive price fluctuations.

Cryptocurrencies have revolutionized the financial world to a large extent. They promise a frictionless transfer of value, and their volatility is expected to simmer down with time.

When this happens, adoption rates will increase, and massive fluctuations might be a thing of the past.

5. Increasing Demand

The increase in the number of digital currency exchanges has enhanced the usability of digital currencies. Today, it is easy to convert cryptocurrency to Fiat currency.

Plus, the massive adoption and popularity of cryptocurrencies have resulted in an increase in demand, hence a notable gain in the value of these digital coins.

Governments are also trying to find ways to implement the use of virtual currencies and leverage their exceptional benefits. Increasing demand is one of the key factors that answer the question ‘how does cryptocurrency gain value’.

What are the Biggest Determinants of Cryptocurrency Prices?

There are several factors that affect cryptocurrency prices. Among those the most important are listed below.

1. Cost of Mining

Cryptocurrencies don’t come from anywhere. Some, like Bitcoin and Bitcoin Cash, are extracted by solving complex mathematical problems through a process known as mining.

This is a process that requires a lot of time, energy, and resources. In case the process of mining cryptocurrencies becomes difficult and its cost increases, this will undoubtedly affect their price.

2. Demand and Supply

When looking for what affects cryptocurrency prices, demand, and supply are factors that must be considered. The higher the demand and the lower the supply, the higher the prices.

The vice versa is also true. In case the demand is low, and the supply is low, then the prices will decrease. Simply put, the forces of demand and supply are what give cryptocurrency value.

However, it’s worth noting that the supply of cryptos is lower compared to fiat currencies. Also, their supply gradually slows down over time. This means that demand will continue to exceed supply, and this will maintain the value of these digital assets.

3. Rules and Regulations

Even though cryptocurrencies are decentralized in nature, governments around the world have introduced a set of rules and regulations to govern them. In some cases, the rules are positive and are meant to protect investors from breaches.

These friendly rules act as a catalyst for strong price increases. In other cases, the rules are highly repressive and restrictive and could lead to a significant fall in the value of any digital currency.

4. Financial Crises

Cryptocurrency valuation largely depends on the economic situation in a particular country. In case the traditional financial system collapses, people naturally consider other assets.

They choose cryptocurrencies as a better form of capital security than inflationary fiduciary money.

Financial crises have a strong connection with the price of digital currencies. The more investors penetrate the market, the greater its capitalization.

5. Power of the Press

You cannot answer the question of how does cryptocurrency gain value without mentioning the media.

Without a doubt, the press can make or break cryptocurrencies. The media is the reel that drives motivations and moods among investors.

The way it writes or presents cryptocurrencies affects their demand. If the media disseminates positive news, the price of virtual currencies will increase.

Nonetheless, if the media decides to send out bad news, it will cause panic among potential investors and might even lead to a quick escape of existing investors from the market. This may lead to massive falls.

If the media educates the public about cryptocurrencies, it will go a long way in enhancing a greater understanding and boosting their adoption. In turn, this will result in a significant increase in prices.

Key Takeaways:

- Cryptocurrencies are so valuable because they enjoy increased popularity and adoption – which means they are in high demand.

- Cryptocurrencies are different from Fiat currencies in terms of divisibility, counterfeit ability, scarcity, transportability, scarcity, utility, and scarcity.

- If the prices of fiat currencies fall due to inflation, the value of cryptocurrencies will go up.

Conclusion

Cryptocurrency presents salient features that provide a solution to challenges associated with fiat currencies.

As a result, they have attracted millions of people, hence increasing demand.

As mentioned throughout the article, only by increasing the demand we can expect cryptocurrency to gain value.

Due to their scarcity and promising future, digital currencies are expected to keep growing in many economies across timelines.

In Tezro we believe in the future of digital currencies. Download Tezro App now to experience a fully encrypted message service that allows you to exchange crypto assets, from Bitcoin to Ethereum.

Read more here about all the features of Tezro app.