The reason why top cryptocurrency trends have become a hot topic is because of the fast-paced changes in the industry over the past few years. Honestly, cryptocurrency has come a long way from when it was first introduced to the world in 2009.

In the early days, it was used primarily by tech-savvy individuals who were looking to avoid government control over their money. Others used it to perform transactions on the dark web. Over time, cryptocurrency has become more mainstream and is now being used by people all over the world to make transactions both large and small.

Last year we analyzed some cryptocurrency trends that were going to be huge in 2021. It was confirmed that indeed they were headlining the crypto blogs and crypto news websites for the whole year.

Now, we will do the same exercise, this time looking at six trends that we believe will dominate the cryptocurrency market in 2022 and 2023.

1. Cryptocurrency regulations

Look – for a long time, governments have been trying to figure out how to deal with cryptocurrency. On one hand, they see the amazing potential that it has to offer businesses and individuals alike. On the other hand, they are worried about the lack of control they have over it.

As a result, we are seeing a lot of different regulations being implemented all over the world. Some countries are choosing to regulate cryptocurrency exchanges, while others are opting for full-on bans. Whatever the case may be, it is clear that governments are starting to take cryptocurrency seriously.

It’s hard to predict exactly what we can expect from cryptocurrency regulations in 2022 and beyond because every country will have its own set of rules and regulations surrounding these types of assets. However, there has been some talk about how governments may look at implementing taxes on crypto transactions. Others may require crypto users to register with the respective authorities before making any trades or purchases. Regardless of how governments choose to regulate cryptocurrency in the future, one thing is for sure: they are going to be more involved than ever before.

Why Would Governments be interested in Regulating the Crypto Market?

Governments are interested in regulating the crypto market for many different reasons. Firstly, they want to get a handle on this new technology before it becomes too popular and widespread. Secondly, they also want to protect their citizens from potential fraud or other types of financial crimes that are associated with cryptocurrency. Lastly, they are worried about tax evasion as well as money laundering activities that could take place using digital currencies like Bitcoin and Ethereum.

As we go into 2022 and 2023, we can expect to see more cryptocurrency regulations being implemented all over the world. Some countries may even try to ban it altogether, while others will take a more hands-off approach. Whatever the case may be, it is clear that this is an issue that governments are not going to ignore for much longer.

What Does This Mean For You?

If you are interested in investing or trading cryptocurrency, then it is important that you pay attention to these developments. If your country decides to ban cryptocurrencies completely, then this could have major repercussions on how you do business with others around the world. However, if they choose to come up with crypto-friendly regulations, then this could actually be a good thing for everyone involved.

The bottom line is that you need to stay up-to-date with what is going on in your country before making any major investments. You don’t want to get caught off guard when new laws are passed!

2. Crypto Metaverse and GameFi

This is one of the top crypto trends that we are watching closely in 2022 and 2023. Over the past year or so, there has been a lot of talk about how Blockchain technology can be used to create a new virtual world – often referred to as the “Crypto Metaverse”. This is essentially a digital world where users can buy and sell different assets, just like they would on eBay or Amazon.

There are already several platforms that have already launched this type of virtual world, and more are set to launch in the near future. Facebook has already rebranded to Meta Platforms Inc. This means that this tech giant will enter the Crypto Metaverse space in a big way. You can read more about the Metaverse here.

What is really interesting about this trend is that it isn’t just for gamers or tech geeks. In fact, there are already several mainstream companies that have jumped on board the Crypto Metaverse bandwagon. Below is a list of companies that are currently trading Metaverse stocks:

- Meta Platforms Inc. (FB)

- Nvidia Corp. (NVDA)

- Qualcomm Inc. (QCOM)

- Unity Software Inc. (U)

- Roblox Corp. (RBLX

- Autodesk Inc. (ADSK)

- Microsoft Corp. (MSFT)

Considering these are giants in the tech world, it is clear that Crypto Metaverse is here to stay. We can expect to see more and more companies getting involved in the coming years.

What Does This Mean For You?

If you are interested in virtual reality or gaming, then you should definitely keep an eye on this trend. The Crypto Metaverse offers a lot of potential for new and innovative gameplay experiences. Additionally, if you are a fan of stocks or investing, then you should also consider getting involved in the Metaverse market. It is still early days, so there is a lot of room for growth!

3. NFTs (Non-Fungible Tokens)

Our list of crypto market trends to look forward to in 2022 and 2023 wouldn’t be complete without mentioning non-fungible tokens (NFTs). These have exploded in popularity over the past year, and they are showing no signs of slowing down any time soon. Anyone can create an NFT, as you can check here.

NFTs are digital assets that can represent anything from artwork to real estate. The demand for these has been driven by the recent explosion in the popularity of collectibles like CryptoKitties and NBA Top Shots on platforms such as OpenSea, Rarible, and Superrare.

The term “non-fungible” means something which cannot be replaced or exchanged with anything else. This makes them ideal for representing items such as artworks since each NFT can only hold one unique item.

What is really interesting about this trend is that NFTs can be used for more than just art or collectibles. They have the potential to revolutionize the way we do business by removing middlemen from transactions and creating immutable records on Blockchain networks such as Ethereum’s ERC-20 standard protocol.

There has already been a lot of hype surrounding NFT markets over the past few years. This is due to their popularity among artists like Beeple who sold a single piece at Christie’s auction house for $69 million USD.

What Does This Mean For You?

If you are interested in art, collectibles, or even virtual real estate, then this could be an interesting trend to pay attention to over the coming years! Investing in NFTs is a great way to get involved with Blockchain technology while also diversifying your portfolio.

4. Web 3.0

The next cryptocurrency trend to look forward to in 2022 and 2023 is Web 3.0. The internet has changed so much over the past few decades. From simple information networks that were once only available through dial-up connections into an interconnected hub of data accessible by anyone with a smartphone or computer.

With this new level of connectivity comes responsibility, we need tools like Blockchain technology to protect ourselves online while still enjoying all these benefits at the same time!

Web 3.0 will take us back in time when people would connect directly on their own terms without any third party’s involvement. It will also bring crypto-assets into the mainstream by giving users more control over what happens with their money. For more information on Web 3.0 and what it involves read this article.

What Does This Mean For You?

The rise of Web Three may lead us back in time when people would connect directly on their own terms, free from third party’s involvement and data collection practices that are commonplace today. It will bring crypto-assets into the mainstream by giving users more control over what happens with their money.

You won’t have to worry about losing access or your data being sold off if something goes wrong at any point in time. This is because everything will be decentralized through Blockchain technology!

5. DeFi (Decentralized Finance)

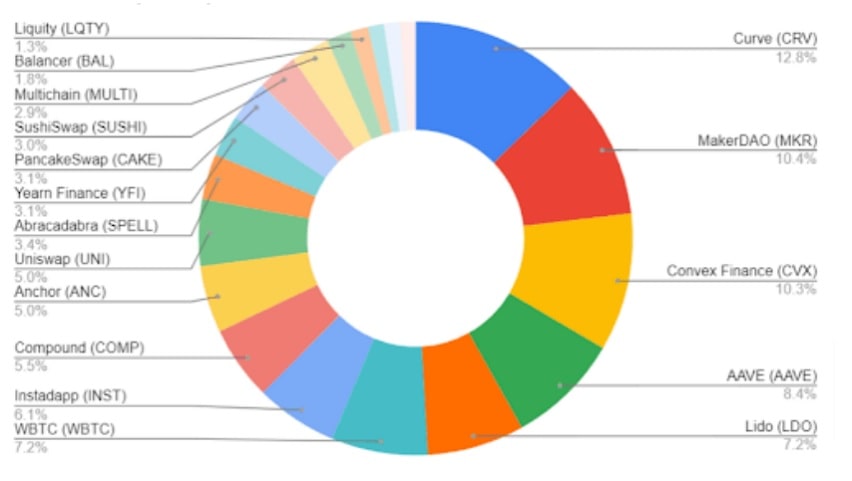

Another top cryptocurrency trend to look forward to is DeFi (Decentralized Finance). It refers to the use of Blockchain technology in financial services and products.

Credits: Cryptonews

This could include anything from lending and borrowing to asset management and payments.

What is DeFi?

Put simply, DeFi is the use of Blockchain technology in financial products and services. This could include anything from lending and borrowing to asset management and payments.

DeFi works by allowing users to interact with each other without the need for a third party. Transactions are conducted directly between two or more parties through a smart contract, which ensures that all terms are met before the money is transferred. This removes the need for trust between strangers, as well as middlemen who often take a cut of the profits!

Today, we have seen an explosion in the number of DeFi coins. There exists hundreds of them. some of the top ones include Aave, Uniswap, Solana, and more. Going into the future, we can expect even more development in this area. More developers will start working on their DeFi projects, and the market will continue to grow at a rapid pace.

We can expect new and more efficient algorithms to come out, as well as new ways of storing data. Developers will seek to enhance more transparency and security in the DeFi space. They will also work to make it more user-friendly so that even those who are not familiar with Blockchain technology can get involved!

We will see improvements in already existing frameworks, including the DeFi Insurance. DeFi Insurance is a project that allows users to insure their digital assets against losses. We will see the rise of more DeFi insurance platforms that will provide more coverage and protection for users.

We can also expect traditional financial products to venture into the DeFi landscape. This will revolutionize how we conduct transactions!

We can expect more people to get involved in the DeFi market because there are so many opportunities for them. We will see a rise in the number of users on platforms like MakerDAO or Aave, which offer loans with interest rates as low as 0.25%.

What Does This Mean For You?

DeFi is a rapidly growing industry that is set to revolutionize how we interact with each other financially. It allows users to conduct transactions without the need for a third party, which reduces costs and removes the need for trust between strangers. As we go into the future, try to take advantage of this new technology by investing and getting involved in decentralized finance projects.

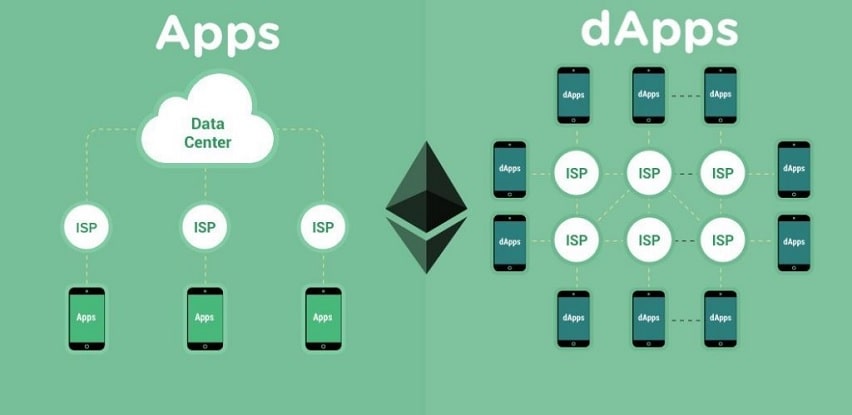

6. DApps

One of the top cryptocurrency trends we cannot overlook is the growth of DApps. They are applications that run on a decentralized network, such as Ethereum or EOS.

DApps are different from traditional apps because they use Blockchain technology rather than central servers to store data and process transactions securely. They are also open-source, which means that anyone can view the code and audit it for security.

This makes them more trustworthy than traditional apps, as users know that there is no chance of data being manipulated or stolen. In addition, DApps are often cheaper to use because they do not require middlemen to process transactions.

DApps are growing in popularity because they offer users more security and transparency than traditional apps. They are also cheaper to use, which makes them a great option for those who are looking for affordable products and services.

We can expect to see even more DApps come out in the future as developers continue to explore the possibilities of Blockchain technology. We will see an increase in the number of DApps that are used for gaming, social networking, and more.

What Does This Mean For You?

DApps are a great way to get involved in Blockchain technology. They offer users security, transparency, and affordability, which makes them a popular choice for those who are looking for trustworthy products and services. If you are looking to get involved in the Blockchain space, then DApps are a great place to start.

- Some trends are a continuation of last year’s trends, like crypto regulations and DeFi;

- New concepts have emerged throughout 2021 like the Metaverse and NFTs and they will likely be on everyone’s agenda this year.

- Web 3.0 is the main topic for 2022, as it might be the beginning of a new digital era.

- dApps are a consequence of Web 3.0 and will change the way mobile applications work.

Final Thoughts

These top cryptocurrency trends are something that we can expect to see in the coming years. They are indicative of the growth and development of this popular industry, and they offer a glimpse into the future of Blockchain technology.

Additionally, these trends show us how important it is to invest in cryptocurrency because this industry will continue to grow for many years.

Therefore, it is important to get involved in the cryptocurrency space now so that you can reap the benefits that the future has in store. Start by downloading Tezro app, to keep your crypto coins safe, in an app that also incorporates a fully encrypted messaging system!