One of the most debated topics in the crypto space is crypto vs. stocks. Most investors are nervous about the stock market and are constantly looking for alternative investments such as cryptocurrencies.

However, they still want to understand whether cryptos are better than stocks so that they can make sound decisions.

Some of the overarching questions in their minds include; should I invest in stocks or cryptocurrencies?

Are cryptos more profitable than stocks in 2022? What are the key differences between stocks and cryptos? To find the answers to these questions, read on!

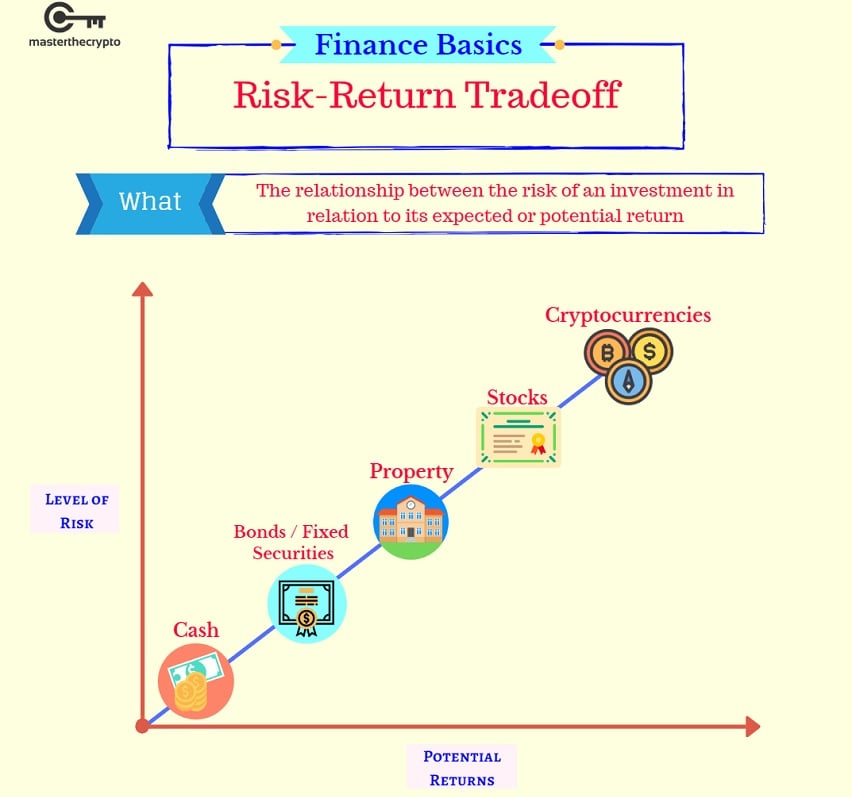

Crypto Risk vs Stock Risk

All investments carry some risk. Weighing the risks between bitcoins vs. stocks is critical in deciding on the assets to add to your portfolio. With individual stocks, there are risks involved.

There is a risk that it might not grow, and dividends might be cut. These are risks that are common with many investments.

What makes stocks different is that there are predictors who offer some guidance investors can use to understand where prices might go.

Cryptocurrencies, on the other hand, don’t have predictors that stock markets do. The crypto market is speculative and completely based on demand and supply. All digital coins are, to some degree, based on what people are willing to pay.

Nonetheless, due to their scarcity, they are subject to huge gains. Therefore, even if cryptocurrencies carry high risks, they have the potential for more profits than stocks.

Investing in Crypto vs. Investing in Stocks: The Main Differences

Below are some key differences between cryptocurrency vs. stocks:

Crypto vs. Stocks: History

Even though you cannot base future performance on the past, one of the best ways to create a rift between bitcoin vs. the stock market is to look at how investments have fared over time.

In 2015, the bitcoin price fluctuated between $200 and $500 per coin. Nonetheless, in December 2017, the price rose significantly, reaching as high as $19,891.

In December 2018, the price dropped to below $3,500. Between March and July 2020, the bitcoin price has bounced between $3,858 and $9,074.

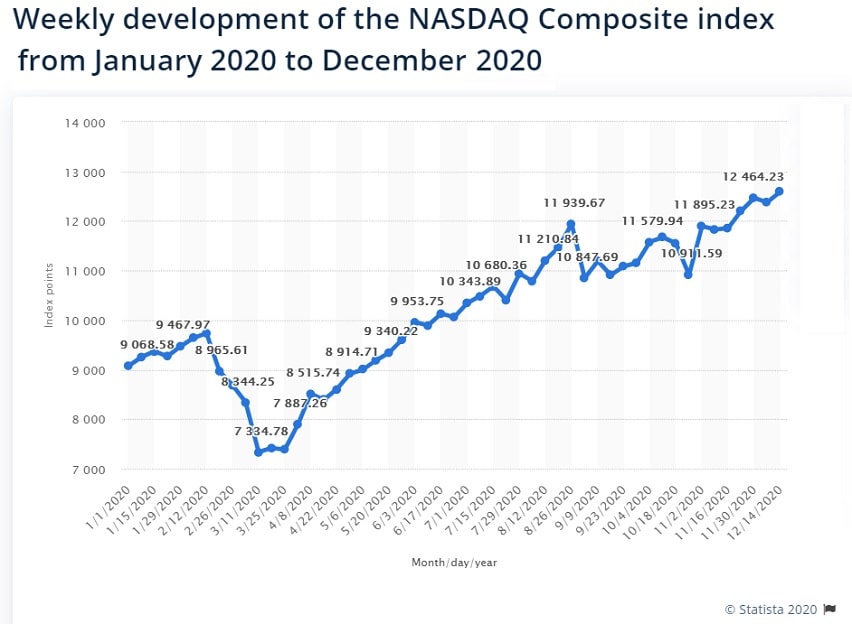

Stock growth has not been as dramatic as cryptocurrency growth. It has been stable since 2018. The S&P 500 index was $2,000 in 2015. Although ups and downs have been experienced through the years, the S&P price stands at $3,100 in 2020.

The reason why we have seen significant changes in cryptocurrency prices over the years is because of its high volatility. This volatility is due to the fact that there is no natural way to value this digital asset.

The prices went to nearly $20,000 in 2017, went down to $3,000, and they are now almost back to $10,000. Stocks have proven to have more long-term historical support.

Still, the volatility of cryptocurrencies makes them more valuable than stocks since they present investors with better opportunities for higher ROI.

Crypto vs Stocks: Volatility

Another difference between stocks vs. crypto is volatility. Cryptocurrencies are often valued based on their popularity and reputation, which makes them highly volatile with extreme highs and lows. The cryptocurrency market is unpredictable and prone to sudden rises or crashes.

On the other hand, stock investors tend to hold on to their stocks during times of volatility, with the hope that things will eventually change.

Most folks will tell you that you should consider investing in stocks over cryptocurrencies. Well, the choice is entirely yours. However, thanks to their high volatility, chances are high that you will get more profits from cryptos than from stocks as long as you embrace the right cryptocurrency investment strategy.

As a recap, don’t forget this – volatility is a two-sided coin of the cryptocurrency world. It offers the potential for profits and losses in equal measure. Therefore, don’t let this discourage you from investing in these digital assets. Invest wisely, and you will make profits!

Crypto vs Stocks: Fraud

Stocks are highly regulated and must undergo rigorous audits so that they can continue to be traded in the market. Due to the intensive scrutiny that comes with making stock, it is highly unlikely that the stocks you choose to invest in will be fraudulent.

On the other hand, cryptocurrency investment is prone to fraud. This is because it is decentralized and unregulated in nature. Over the years, many scams involving crypto exchanges, trades, and mining have been reported, with investors losing thousands of bucks.

Though, this does not mean that you shouldn’t invest in cryptocurrency. As long as you find a secure wallet to store your valuable assets such as Tezro, there is no reason why you should not worry about your coins being stolen.

Click here to know more about Tezro features and why you should put your trust in Tezro.

Also, make sure you join legit and reputable exchanges. When you do this, you will make the most out of the lucrative cryptocurrency industry.

Crypto vs Stocks: Privacy

Privacy is another element that differentiates the stock market vs. cryptocurrency. When you purchase a stock, it is issued in your name, and the evidence of your ownership is out there.

Due to record-keeping and tracking involved, it is very easy for authorities or even individuals to find out the details of a transaction.

Even though the cryptocurrency transaction details are displayed on a public ledger, names and other personal details are not displayed. This means that nobody can find out that you made a particular payment without your consent.

Crypto vs Stocks: Ease of Entry

Trading crypto vs. stocks is different based on ease of entry. Stocks are highly regulated. This means that you need to do a lot of paperwork to get started.

You must provide a lot of information and sign declaration forms that will add to the cost and time needed to start trading. You don’t need any paperwork to start trading on crypto.

There are no requirements for intermediaries such as brokers, and you don’t have to sign any declarations. This saves you time and money and increases your chances of making more profit.

Crypto vs Stocks: Timing

Stock trading has its sessions, and there is no trading on weekends and public holidays. Events happening in real life, such as natural disasters, have an immediate impact on trades.

Cryptocurrency trades are different. Crypto exchanges work around the clock. They are not affected by holidays and weekends or any events in real life.

This means you can act fast and make profits whenever you find a perfect opportunity to trade.

Who Is A Good Fit For Stocks?

To better understand the differences between the crypto market vs. stock market, you need to know who is a good fit for stocks. Stocks are appropriate for the bulk of any portfolio.

Thanks to their underlying characteristics, stocks are stable and can give returns for quite a long time. Even with some short-term volatility, most companies will exist in the future, and this guarantees stability.

Below are some of the reasons why you should invest in stocks:

Money Sitting in Cash Will Lose Value

Due to inflation, the money sitting in your drawer or bank account will lose value with time. Look – if you save $10,000 today, it will not be $10,000 in five years.

Well, it will still be 10,000 bucks, but it will not be worth what it was worth when you first earned it. When you invest in stocks, your investment will not lose value. You will continue earning dividends for a long time.

Save For Retirement

When you invest in stocks, you will have a nice huge nest egg to live off when you retire. Investing in stocks is a great way to save for the future.

Steady Income

Stocks, especially dividend stocks, give you real hard cash on a regular basis.

This means that even if you lose your job or your contract suddenly comes to a halt at the end of the year, you will have something to pay your bills before getting another opportunity.

Become Part of The Company You Love

When you purchase stocks, you automatically become its part-owner. If you are passionate about particular brands and products and you would love to own a piece, consider buying stocks!

Who Is Good Fit For Crypto?

If you want to hold a valuable asset away from fiat currency, cryptocurrency is a good fit for you.

Factually, cryptos hold more risks than stocks, but they are equally rewarding.

There are many reasons why you should invest in bitcoin and other cryptocurrencies. They include:

Incredible Returns

One of the main differences between crypto vs. stocks is that the former guarantees more returns than the latter.

For example, the highest returns you can anticipate from US stocks is 15-20%. Cryptocurrencies show huge changes in their prices over short periods.

With the right strategies, you can make admirable profits from digital coins.

Independent Alternative

Wealth investors across the globe are predicting a stock market crash in the next few years. Cryptocurrency might be a safer alternative to all traditional investment solutions.

Experts believe that cryptos will continue to thrive, and this is one of the reasons you should consider investing in them.

Simplicity

Trading in stocks is traditionally bothersome, complicated, and time-consuming. Joining and taking part in cryptocurrency trading is easy. You don’t need to undergo vigorous steps and procedures to get started.

All you need to do is create an account, get a wallet, and start trading your assets without any effort.

High Liquidity

Cryptocurrencies have high liquidity. This means you can quickly and easily buy and sell them.

Technological organization of trading platforms allows the use of a myriad of tactics and tools, such as limit orders and algorithm-based trading.

These strategies permit automated trading at a specified selling price.

Stock Markets are Equally Risky!

The biggest difference between investing in crypto vs. stocks is that cryptocurrencies have a significant risk. It is, however, worth noting that the stock market is equally risky.

When you invest in the stock market, returns are not guaranteed. Even though there are many things that can help you predict how a stock will perform in the future, there is no guarantee that prices will shoot or the company will pay dividends. Also, there is no assurance that the company will stay in business!

The returns you get from your stocks depends on how much they are worth when you sell them. This poses a risk since you might earn less than you initially invested.

Look – stock prices often change for many reasons. When there is a downward trend in the market, you might lose all your money when you buy and sell stocks.

This is especially the case if you are not planning to invest in the long term. If you utilize leverage to invest in stocks, such as short selling or buying on margin, you could potentially lose more than you invested.

Stock trading vs. cryptocurrency trading is different in terms of volatility. Crypto trading is more volatile and riskier. Surprisingly, this is also true for stock trading.

There are regular ups and downs in the stock market. There are stock prices that change quickly due to an array of factors, and this makes them volatile and riskier.

If such a price drop is predicted and you try to get your money out on short notice, you could end up making significant losses.

Common Risks That Every Stock Faces

Stocks face different types of risks. They include:

Commodity Price Risk

This is basically the risk of a swing in commodity prices affecting the company.

If you buy stocks from a company that sells commodities, you will only make profits when prices go up, but you will make losses when prices drop.

Headline Risk

This is a risk of negative publicity that comes from stories in the mainstream media.

Rating Risk

Credit rating and analyst rating are the two most important ratings that could have a negative or positive impact on companies that trade publicly.

Negative ratings could lead to a downward trend in stocks, which means investors can lose money.

Detection Risk

This is the risk that the regulator, auditor, compliance program, or any other authority fails to find until it’s too late.

It includes improperly stated earnings, management skimming money out of the company finances, and other types of financial shenanigans.

Detection risk damages the company’s reputation – which might be impossible to repair. This leads to a significant fall in stock prices.

Legislative Risk

This is basically the tentative relationship between the government and the company.

Specifically, it is the risk that actions by authorities will constrain a company, therefore adversely affecting investors’ holdings in that industry.

Other risks involved in stock trading include model risk, interest rate risk, inflationary risk, and more!

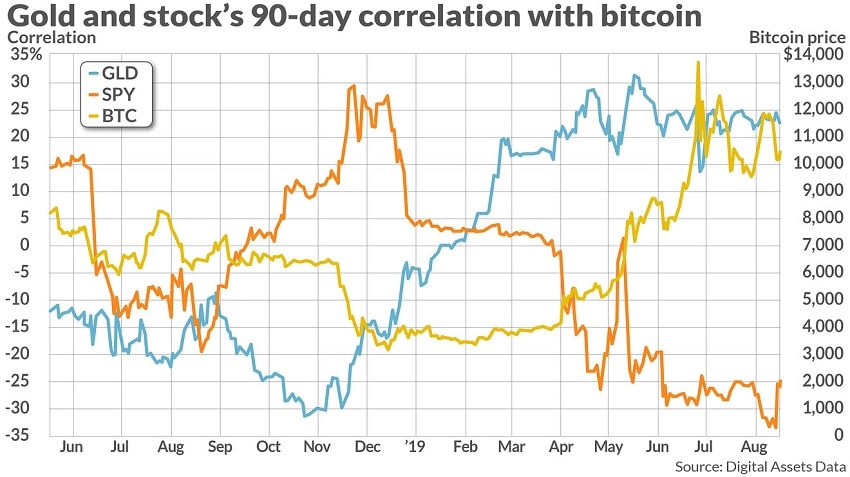

Credits: MarketWatch

Is It Worth Investing in Cryptocurrency?

We can find an abundance of positive sentiments around cryptocurrencies. Some investors compare cryptos to gold as a potential store of value since they increase their relative worth against fiat currencies and gold.

There are many reasons why you should invest in cryptocurrencies, but you must first understand the market and the underlying risks. These digital assets are useful for portfolio diversification.

They are a hedge against inflation and geopolitical uncertainty. As they become more widely accepted as a mode of payment, they will gain acceptance as legitimate asset classes.

When you invest in cryptocurrencies wisely, you will join the bandwagon of high-net-worth investors in no time.

Key Takeaways

- Stocks are as risky as cryptocurrencies.

- High volatility is not a huge disadvantage of the cryptocurrency world. It comes with highs and lows that could result in gains or losses in equal measure.

- As long as you choose the best investment strategy, cryptocurrencies are some of the best assets to invest in.

Conclusion

Without a doubt, the difference between crypto vs. stocks is evident. Cryptocurrencies are more volatile and riskier, but this doesn’t mean that stocks are not risky.

Cryptos are more profitable and offer high liquidity than stocks. Therefore, if choosing between the two was an option, it is highly recommended that you consider investing in both stocks and cryptocurrencies, but pay much attention to the latter.

Read this article as a guide, make the best decisions, and you will, without a doubt, make a kill out of your investment.

Plus: don’t forget to download Tezro, where you can manage your investment in a fully encrypted text message app!