2020 has been a wild year for cryptocurrencies and it looks like the ride is only going to get wilder. Bitcoin is clearly on the tip of everyone’s tongue at the moment, having hit an all-time high of $58,000 recently.

Now with crypto markets going through a correction, investors are understandably concerned with the direction of things. Cryptos such as Ethereum, Dogecoin, Litecoin, Bitcoin Cash and XRP have also taken a hit.

In the midst of all this chaos, the term “market capitalization” appears to be continually brought up. Everywhere you look, you’ll see analysts citing how Bitcoin or some other crypto has lost or gained a particular amount of market cap.

You ask yourself, what is market cap and how does it actually affect my investment? Should you be concerned about the market cap of your chosen crypto investment or is this just another fancy term thrown around by analysts trying to look smart.

To find out more about crypto investments read this article from our blog.

If you’ve asked yourself those questions, then you’ve come to the right place. In this article, we’ll take a look at market capitalization, its relevance to crypto assets, and whether market cap is a good measure of value.

Along the way, we’ll list the top 5 cryptocurrencies by market cap and discuss their most pertinent points.

So, let’s get started.

What is market capitalization?

If you’re looking to get aboard the crypto train, you’ll most definitely want to know what market capitalization is.

Crypto market capitalization is used as a measuring system to determine the size of a particular type of cryptocurrency.

How to calculate crypto market cap?

How to calculate crypto market cap?

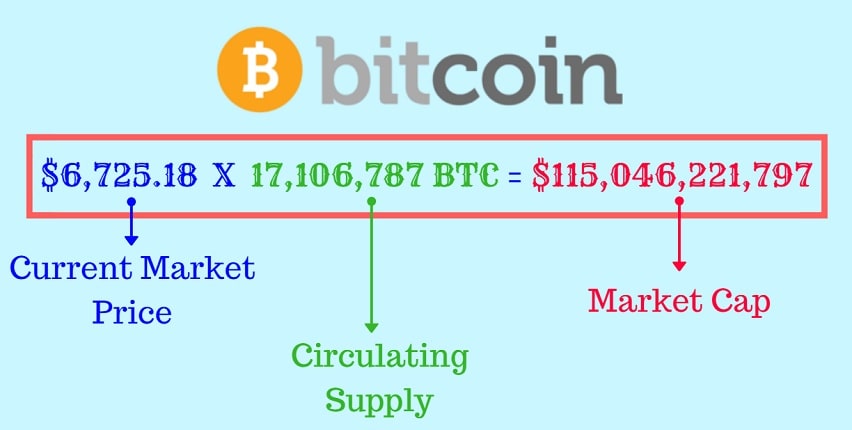

Market capitalization provides analysts with an idea of how good or poorly a particular company or cryptocurrency is performing. It can be calculated by using this simple formula:

Market Cap = Current Price x Circulating Supply

Current price refers to the price in which a particular coin is trading at during said point in time. Meanwhile. circulating supply refers to the total quantity of Bitcoins currently being circulated in the market hence the name.

For example, let’s say that Bitcoin is currently trading at $1000 per token and the circulating supply stands at 1000 coins. Multiplying $1000 x 1000 coins gives us a total market capitalization of $1,000,000.

It is extremely important to note that an asset’s market cap does not provide an indication of an asset’s liquidity or any inflows of cash.

Market capitalization numbers only reflect an asset’s presence and performance in the market along with its value. Fluctuations in an asset’s value will severely affect its market capitalization.

This is especially obvious in the cryptocurrency market where extreme volatility can create or destroy billions of dollars’ worth of market cap at any time.

Given how Bitcoin valuations have gone through the roof in recent months, it has become commonplace for any sudden price changes to send investors scrambling.

Another point to note is that market capitalization should not be equated to the amount of fiat currency that has actually been invested in cryptos. Here are the reasons why:

- When a coin is mined, it is not immediately purchased by investors in the market. If 300 coins are in circulation but only 1 coin is purchased at $10, the total crypto market cap is $3000 while the amount actually invested in only $10. Most new investors tend to make this mistake when they first get into cryptos.

- As was mentioned in the section above, the crypto market is an extremely volatile one. Just because the price of a crypto increased by 3000% doesn’t actually equate to a 3000% increase in investment. It only means that market capitalization has gone up while the amount of cash in the market remains the same or has only increased slightly.

- A crypto’s market cap is not a good measure of its actual value. For example, an increase in Bitcoin’s price would definitely drive market capitalization up, thus investors liquidating their assets in order to crystallize their gains. However, the sudden increase in supply and fall in demand would cause crypto prices to crash in turn.

There is a clear disconnect between crypto market cap and the actual amount of cash in the market. So why is that market cap so relevant to cryptos?

Why is market cap relevant to cryptos?

Why is market cap relevant to cryptos?

Unlike conventional assets such as cash or stocks, cryptocurrencies are unregulated and wholly decentralized. Thus meaning that the supply of coins in the market is controlled entirely by the community i.e. miners.

Because of this, crypto market cap can be used as a good indicator of a particular cryptocurrency’s presence in the market.

If you go back to the formula, you’ll remember this: Market Cap = Current Price x Circulating Supply. The higher a currency’s circulating supply in the market, the more dominant said cryptocurrency is. Hence why market cap is often used as an indicator of a crypto’s popularity in the market.

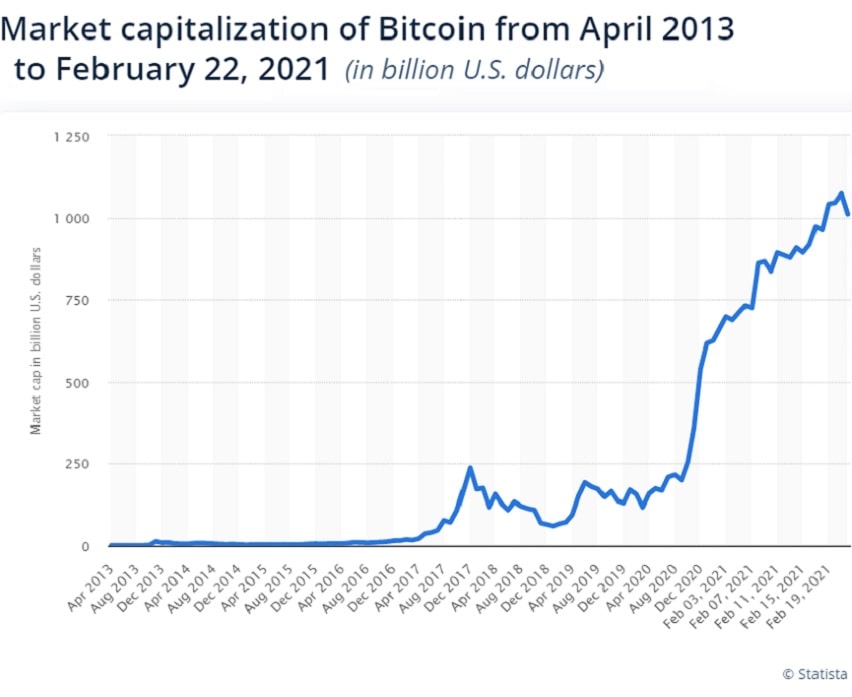

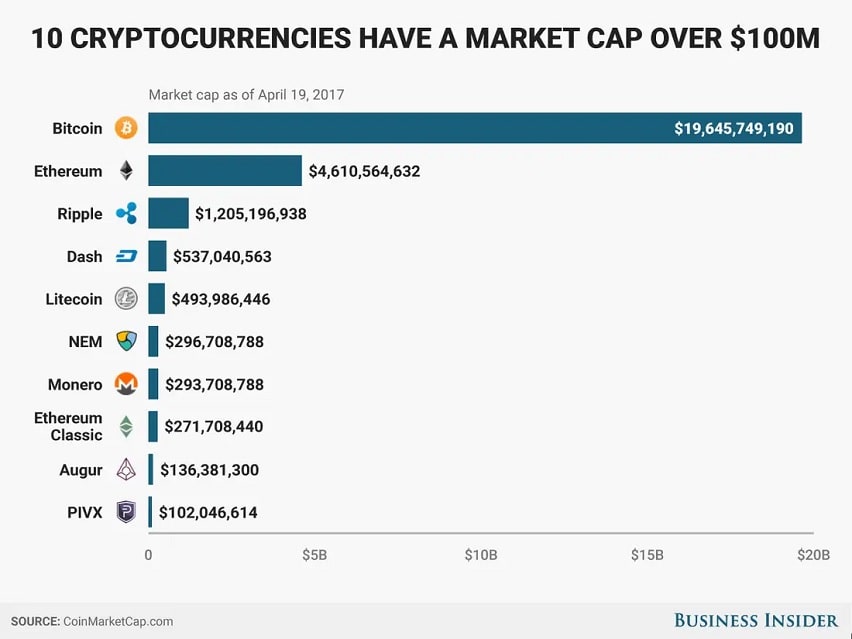

Bitcoin is the oldest and most popular cryptocurrency in the world with an estimated market capitalization of $1 trillion. Given how wildly crypto prices change day to day, this number is liable to change at any point in time.

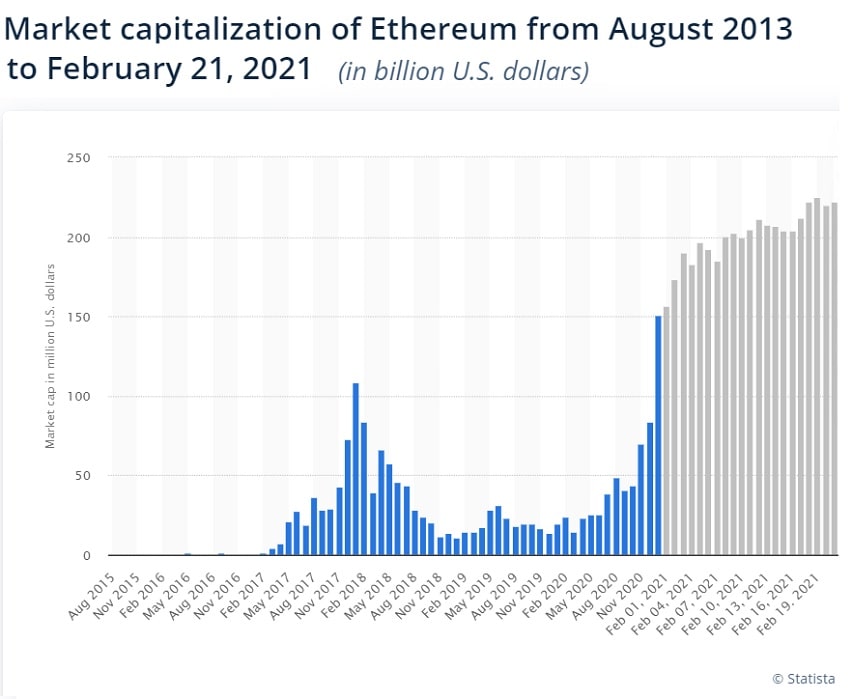

The closest contender to Bitcoin is Ethereum, with a market cap of about $165 billion. Given how Bitcoin is the most widely accepted cryptocurrency around the world, this should come as no surprise.

Is market cap a good way to measure the value of crypto?

No, market capitalization is in no way an indicator of a cryptocurrency’s value. However, it is a good indicator of a currency’s popularity i.e. higher demand, higher price and general circulation in the market.

While there are a total of only 21 million Bitcoins available, BTC is valued at nearly 40 times that of its closest contender; Ethereum. Thus giving it the largest market cap.

These 2 differing extremes should make it clear that market cap is not a reliable way of determining a cryptocurrency’s actual value. All too often, amateur investors have repeatedly fallen into this trap – resulting in them losing their entire investment.

To learn more about cryptocurrency value click here.

Top 4 Cryptocurrencies by market cap

Now that you’ve gotten an idea of why the crypto market cap is a vital metric for any investor, let’s take a look at the top 4 cryptocurrencies by market capitalization.

It should come as no surprise that Bitcoin occupies the top spot on this list with a total crypto market cap of around $1.7 trillion at the time of writing. Created by the mysterious Satoshi Nakamoto, Bitcoin is the first successful cryptocurrency in history. Intended to be an inflation-proof currency, Bitcoin has come a long way over the years.

Originally prized by surfers on the deep web and used as the main medium of exchange on the Silk Road, Bitcoin was initially viewed with suspicion by most. However, thanks to the evolution of blockchain technology and changing mindsets, Bitcoin is now the most widely accepted cryptocurrency in the world.

The total number of Bitcoins available is locked at 21 million, meaning that no more coins will be produced once the supply has been exhausted. This was done to make it impossible to flood the market with Bitcoins and thus prevent inflation caused by irresponsible government fiscal policies.

Despite all this, Bitcoin still comes out on top in terms of market capitalization – something that can be attributed to the strong demand for Bitcoin which drove up BTC prices. Thus giving it the largest crypto market cap.

To know more about Bitcoin watch these 12 documentaries we recommend.

Ethereum is a decentralized, open-sourced blockchain platform that offers smart-contract functionality along with a host of other features. It is the most popular block-chain platform and is used in a variety of industries, from medical to finance.

As of this time, there are more than 100 million Ether tokens in circulation with the team opting to not have an upper limit on the total coin supply. Theoretically, this would mean that Ethereum could potentially outpace Bitcoin as the asset with the largest crypto market cap.

Read more about the difference between Bitcoin and Ethereum here.

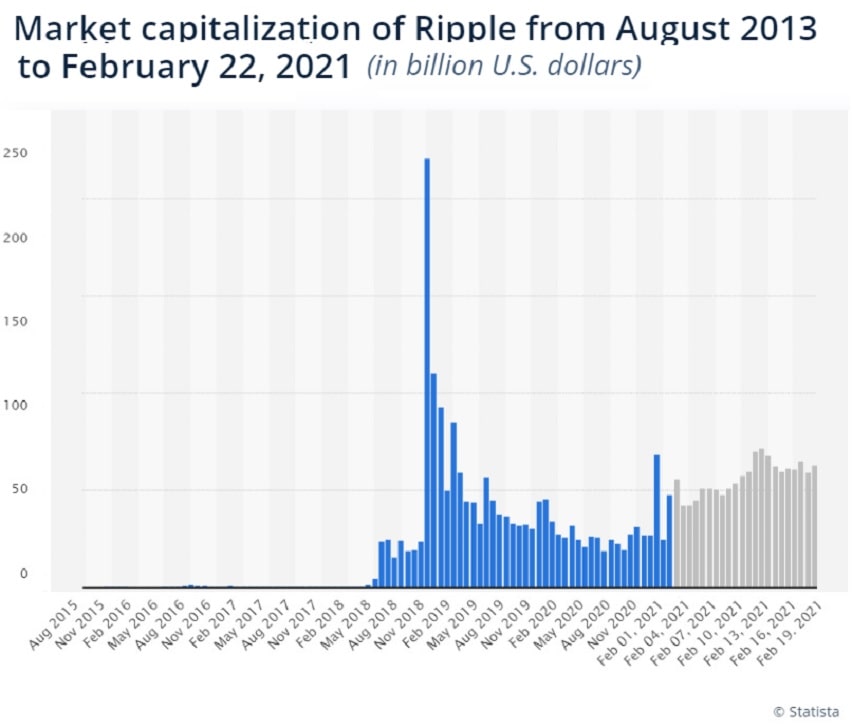

Unlike Bitcoin or Ethereum, the team behind XRP claim that the digital asset allows vast quantities of funds to be transferred instantaneously for a fraction of what it would normally cost.

This has made Ripple and XRP a popular choice for fintech and finance companies looking to leverage on the power of new generation technology.

While XRP valuations are not even a fraction of other cryptos, XRP is able to have such a high crypto market cap due to the large quantities of XRP available in the market.

While blockchain tech allows for funds to be transferred from anywhere around the world, the vast quantities of transactions on an ever lengthening blockchain means that processing times have suffered accordingly.

These turns of events would eventually lead to the development of Bitcoin Cash. Unlike Bitcoin, Bitcoin Cash was specially developed to be scalable in response to the needs of customers. This has allowed for BCH to support faster transaction times whilst still keeping fees low.

With a market cap of around $9 billion, Bitcoin Cash is the 4th most dominant cryptocurrency in the world.

Final thoughts

From increased acceptance to the looming spectre of an economic meltdown, it is clear to see that the future of cryptocurrency is set to be a bright one.

Meanwhile you analyze which crypto to invest, you can rest assured that Tezro keeps your assets safe. Download Tezro app, a fully encrypted app that allows you to exchange cryptocurrencies with complete trustworthy security.

How to calculate crypto market cap?

How to calculate crypto market cap?

Why is market cap relevant to cryptos?

Why is market cap relevant to cryptos?