The difference between token vs. coin has created a heated discussion among the cryptocurrency community. In fact, “coins” and “tokens” are some of the cryptocurrency terms that are hard to comprehend. Most people use them interchangeably.

There are those who use the term “token” to refer to what others call “coins,” while there are those that use both names to refer to all cryptocurrencies available on the modern market.

It is worth noting that these two terms are different in many aspects. It is important you know what they are before you decide to immerse yourself in the world of cryptocurrency.

This comprehensive article seeks to answer the question: what is the difference between a coin and a token?

We look at each term independently and analyze why there is so much confusion among them. We will also look at examples of each and outline their uses.

Token Vs. Coin: What Is A Coin?

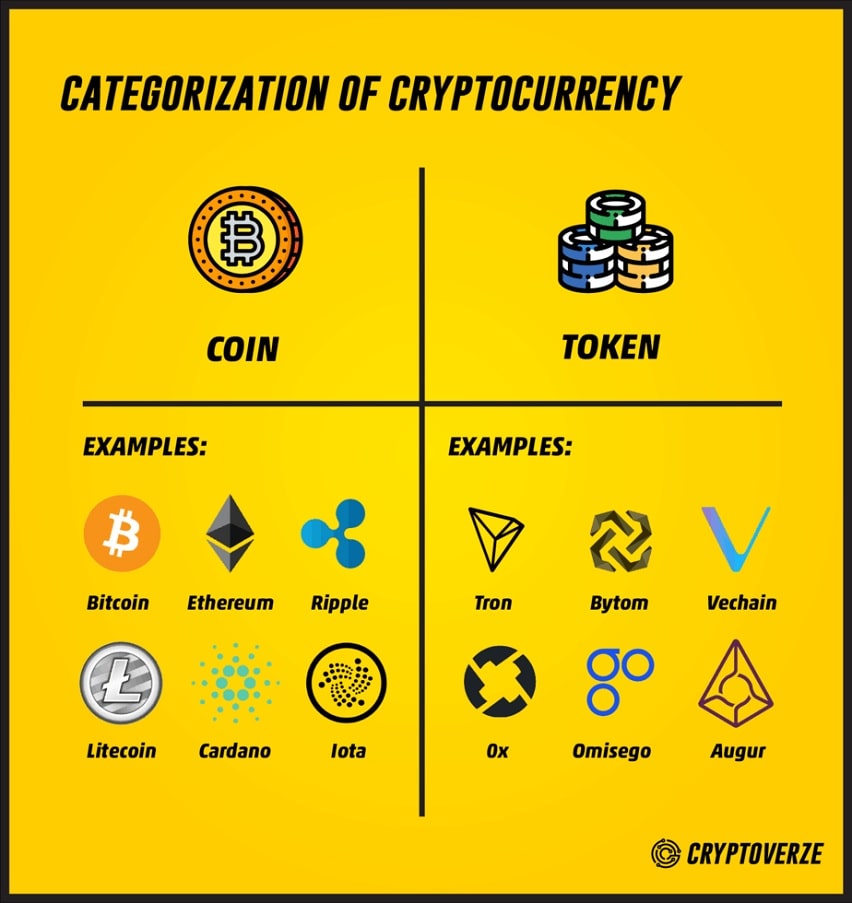

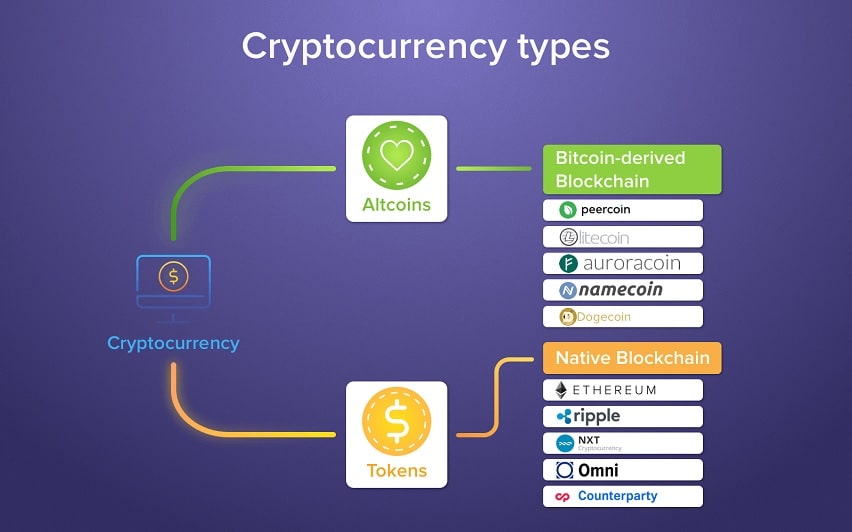

Also known as altcoins or alternative cryptocurrency coins, coins are digital money that is created using encryption methods.

They store value over time. Essentially, coins are the digital equivalent of money. Transactions of these coins can be made from one party to another. They exist as data on a huge global database.

This database, popularly known as a blockchain, records all transactions and is verified and checked by computers around the globe.

Digital coins are used in the same way as physical coins. If you own digital coins like Litecoin or bitcoin, you can think of them as the coins in your house or wallet.

They have the same features as real money: they are acceptable, portable, fungible, durable, divisible, and scarce.

Unique characteristics of coins

- They are tied to an open blockchain. This means that anyone can join and participate in the network. However, cryptography protocols are used to ensure all users are pseudonymous.This means that even if your transaction history is available to the public, there is no personal information attached to your wallet address. Simply put, no one can find out your identity in a blockchain network!

- They may be mined, sent, or received

To better understand what coins are, let us look at Bitcoin.

Bitcoin is based on blockchain technology. This is a distributed and public ledger that ensures all transactions can be seen. Data is collected, stored, and shared among participants of the blockchain network.

Just like other digital coins, Bitcoin reduces the possibility of fraud, and guarantees transparency.

Thanks to their wide acceptance and uses, ambitious crypto enthusiasts believe that coins will replace conventional money in the near future.

How Is A Coin Used?

Factually, digital coins are not meant to perform any other functions beyond acting like money. Yes, coins are used as money, and that’s all!

How Do Digital Coins Work?

Sending and receiving digital coins is like sending an email. To start receiving an email, you need to create an email address and share it with others.

To send an email from the address you created, you need to know your address and the password. This information is confidential and shouldn’t be shared with anyone.

Acquiring coins follows the same method. You are assigned a special address known as a public key. When you get this address, you are then assigned a password known as a private key.

You need both the public and private keys to send and receive digital coins. These two keys are confidential and shouldn’t be shared with others.

For the avoidance of doubt, it is worth mentioning that coins don’t entirely function the same way as emails. For instance, you get to pick your email and password when creating an email.

However, public and private keys are assigned to you. These keys are linked together using a complex algorithm to ensure they link up to the same account. Also, unlike when creating an email, you don’t provide your personal information to set up private and public keys.

When you lose this information, you cannot regain access to your coins by validating your identity.

Digital coin transactions do not take place instantaneously. This is because records are kept on multiple systems, and they take time to validate transactions and agree to include them in the blockchain.

Digital coin users pay some fees for sending coins to other users. Fees vary significantly depending on the coin used. The high demand for these coins may lead to an increase in these fees.

Examples of Coins

There are hundreds of coins available on the crypto market today. They include:

- Stellar (XLM)

- Ripple (XRP)

- Cardano (ADA)

- NEO (NEO)

- Monero (XMR)

- Dash

- Ether

- …and more!

Token Vs. Coin: What Is A Token?

The topic of coin vs. token cryptocurrency, and most people, including crypto experts, tend to refer to tokens as digital coins. This is not right!

Tokens are digital assets that are issued by a project. They can be used as a mode of payment inside a project’s ecosystem.

They perform a similar function with coins, but the main difference is that tokens give the holder the right to participate in the network.

Individuals and businesses may provide digital tokens to raise funds for an array of projects, including software, alternative cryptoassets, and a myriad of other products and services.

Companies or individuals promoting digital tokens can promise high returns to investors, but you need to be careful when investing in them.

If you don’t invest with caution, you may be at risk of losing your hard-earned money.

Initial Digital Token Offering Explained

Digital token offering is managed over the web, and it allows people to visit a website and buy digital tokens using fiat currency and other cryptoassets such as ether or bitcoin.

The digital tokens provided may have a laid-out future use, such as allowing buyers to use them as alternative crypto assets or give them future access to a particular digital platform.

Before we dive deeper into the difference between coin and token, there are a few things you need to consider before participating in a digital coin offering. They include the following:

Digital tokens are securities

Most, if not all, sales of digital tokens are subject to regulations involving the sale of securities.

In case you purchase digital tokens whose value is tied to future profits or the success of a company, they will be considered a security.

Therefore, ensure you ask questions and request relevant documentation before you invest.

Digital tokens have limited use

Digital tokens may have limited use, and you may not be able to use them as you would with digital coins. In fact, if the company selling digital tokens doesn’t achieve its goals with money raised from selling digital tokens, the tokens might have no use.

Therefore, you need to know that investing in digital tokens is like buying a promise that a company will deliver a product or service in the future. You may need to wait for months or even years before your investment bears any fruits.

Types of Tokens

There are different types of tokens. Here are some examples.

Utility Tokens

Utility tokens are also known as application tokens. They are sold to fund the development of a cryptocurrency and can later be used to purchase goods or services offered by the issuer.

Some examples of utility tokens include Civic, Timicoin, Sirin Labs Token, Golem, Siacoin, Filecon, and more.

When looking at cryptocurrency token vs. coin, utility tokens should not be confused with coins such as Litecoin, Monero, Bitcoin, and more.

This is because they are not mineable and are often based on third-party blockchain. Similar to coins, utility tokens are valued for their inherent functions and properties.

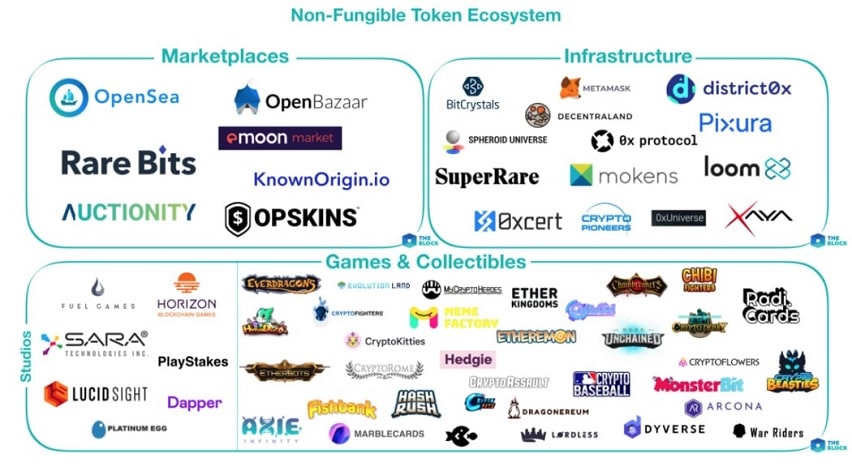

Non-fungible Tokens

Non-fungible tokens (NFT) are tokens that contain identifying information recorded in their smart contracts. Unlike fungible tokens such as bitcoin, non-fungible tokens are not divisible.

This means that you cannot send part of the token to someone else. Every non-fungible token has unique information stored in its smart contract.

Therefore, NFT cannot be directly replaced by another token. What makes them unique is that they are linked to a specific asset. They can be utilized to prove ownership of digital and physical assets.

They are not traded on standard cryptocurrency exchanges. Instead, they are sold or bought on digital market places such as Openbazaar.

Examples of non-fungible tokens include domain names, game items, event tickets, digital art, collectibles, ownership records of physical assets, and more.

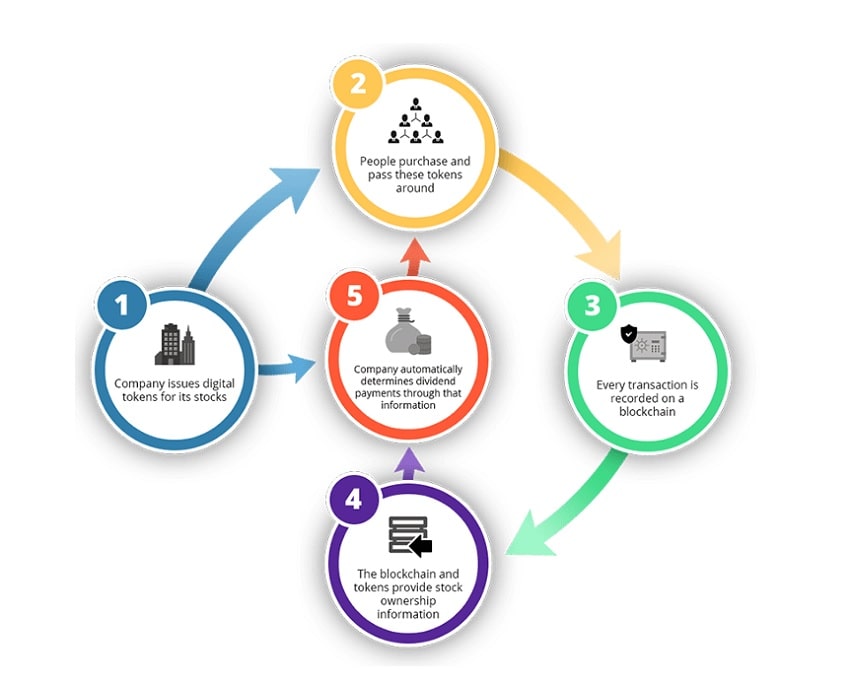

Security Tokens

These are tokens that equate to an ownership stake in a business. When you invest in security tokens, you are doing it with the intention that its value will be derived from the value of the business or its future dividends/profits.

Today, there are many systems, regulations, and valuation methodologies for doing security tokens. This makes them restrictive on who can buy them. In the US, for instance, you need to be an accredited investor to purchase security tokens.

This means you must have an income of over $200,000 or have a net worth of at least $1 million. Of course, laws vary depending on the country, but in most cases, they are treated as traditional securities.

Key Differences between Coin and Token

There many factors we can use to differentiate crypto coins vs. tokens. They include:

Definition

After reading this article to this point, it is evident that understanding the difference between token vs. coin is as difficult as most people believe.

Understanding the difference between the two starts by knowing what each one of them means. Coins are native to their own blockchain, while tokens are built on another blockchain.

Usage

Coins are used as money. However, some coins have other uses. They are utilized as a stake to validate transactions and can be used to fuel token transactions and smart contracts.

On the other hand, tokens are created to be utilized as dAPPs, and their function depends on the application they are built on.

In some cases, they are used to reward users with things such as access to future platforms, discounted fees, goods and services, and more. In other cases, they are for particular features such as voting rights.

Note: Coins can be used to buy tokens, but tokens cannot be used to buy coins.

Complexity

Creating a token is much easier than creating a coin. When creating coins, you need to solve complex mathematical problems through a process known as mining.

Mining is a complicated process that requires special software, hardware, and other computer resources to achieve. It is basically verifying transactions that happen on a blockchain.

As a reward for verifying transactions, miners are rewarded with coins. Mining is one of the most popular ways of making money, but it is not as simple as it used to be a few years ago.

Therefore, instead of mining, some crypto experts choose to get coins from exchange services.

The process of creating tokens is easy. You don’t have to create a new code or modify an existing one. All you need to do is use a standard template that is found in platforms such as Ethereum.

These templates are blockchain-based, and they allow anyone to create tokens by following a few basic steps. Using templates to create tokens offers smooth interoperability – and this allows users to store different tokens in a single wallet.

Key Takeaways

- Crypto coins and crypto tokens are all used to refer to cryptocurrencies in general. Additionally, there are people who use “tokens” to refer to “coins” and vice versa. However, these two terms are different.

- The main difference between token vs. coin is that coins are native to their blockchain while tokens are built on existing blockchain like Ethereum.

- Coins are only used as money, but tokens have an array of uses based on a project‘s ecosystem.

- Coins can be used to buy tokens, but tokens cannot be used to buy coins.

Conclusion

For most people in the cryptocurrency world, the discussion of coin vs. cryptocurrency or token vs. coin is not given much attention because it is perceived as the same thing.

Fundamentally, these two rather confusing terms are different. Perhaps the most basic explanation or that difference is that tokens are built on an existing blockchain while coins are native to their blockchain.

When talking about tokens vs. coins, it is worth noting that they share one significant similarity – they are both high-risk investments that can be high on rewards.

This is what makes them appealing. In particular, tokens can be very rewarding if you invest in the right initial coin offering (ICO).

Nonetheless, to make the best out of both coins and tokens, you need to do research before making an investment.

Also, re-reading this article to better understand the difference between crypto coin vs. token can be rewarding.

Finally, don’t forget that one of the best services that allow you to store multiple coins and exchange crypto assets is Tezro. Download our app and read more here about the full list of features!