One of the most searched items by digital currency enthusiasts is how to make money with cryptocurrency. A recent study shows that the crypto space evolves in circles.

The first circle involves a significant increase in the prices of cryptoassets. This drives traditional and social media buzz.

The wide coverage and excitement bring more investors into space and contribute to new ideas, codes, and the development of new projects.

Once this happens, the next circle begins.

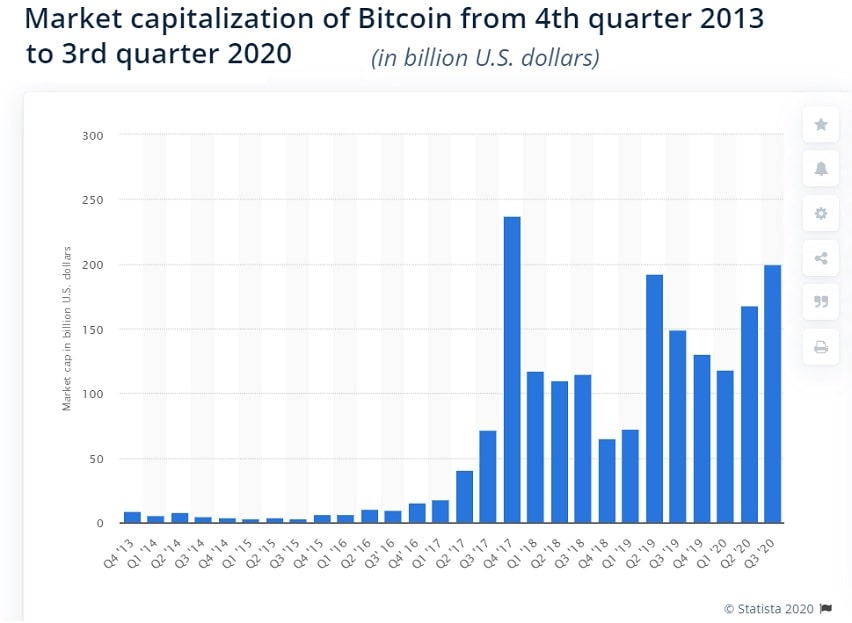

Until now, we have seen three crypto circles that peaked in 2011, 2013, and 2017. In every circle, we saw a price fall in every circle.

Despite this, there has been significant growth in social media activity, developer activity, and most startups have joined the crypto space.

Experts project that the next cycle will see a price appreciation thanks to the ever-increasing interest in cryptocurrencies. This will provide investors and traders with effective ways of making money with cryptocurrency.

Wondering how to make money with bitcoin and other cryptocurrencies? Here are some practical ways you can try:

Investing

One of the best ways of making money with Ethereum and other cryptocurrencies is through investing. Investing is basically taking a long-term view by purchasing and holding assets for a particular period of time.

Crypto assets are well suited to the purchase and hold strategy. Generally, they are volatile in the short term, but they have great long-term potential.

Pros of Investing

Cryptocurrency investing comes with several benefits that include the following:

The returns exceed the stock market by big margins

If you invest in the best mutual funds in the market, you could get about an 11% annual return.

Nonetheless, you could get up to 50% annual returns when you invest in cryptocurrencies. Investing is, therefore, a great way of making money trading crypto.

You don’t need to be rich to start investing

The main reason why most people fear investing in cryptocurrency is that they think they need millions of dollars to start. This is far from the truth.

Even though a single bitcoin costs thousands of bucks, you don’t need to buy a whole bitcoin to start making crypto profits.

Bitcoins, just like other cryptocurrencies, are divisible. In fact, they can be divided into 8 decimal points. This means that you can invest with as little as you can afford.

There are free and simple resources to help you learn

If you are worried about not having enough information about investing, don’t worry! There are ample resources online that can help you learn. You can check crypto news sites, blogs or join online forums to find guidance that will give you a perfect starting point.

Liquidity

You probably wouldn’t expect it, but investing in cryptocurrencies is surprisingly liquid. There are many retailers around the world who now accept bitcoins and mother cryptocurrencies as a form of payment.

This means that you can exchange these currencies for physical money or goods faster.

Cons of Investing

Investing in cryptocurrencies is not a bed of roses. It comes with its fair share of cons that include:

You cannot trade in real-time

Investing in cryptocurrencies, including the fastest altcoins, means you must experience wait times.

Some cryptos also demand that you have proof-of-work to have transactions verified, which could take up to 30 minutes depending on the currency you are dealing with.

This is a minor issue but one that could cost you some profits!

The biggest boom has passed

Even though cryptocurrencies keep rising in value, one of the drawbacks of investing in them is that the biggest boom has passed.

However, this doesn’t mean you cannot enjoy cryptocurrency profit if you invest wisely.

Security is an issue in crypto

In case you have been paying attention to recent news in the cryptocurrency world, you may have noticed that cybersecurity is a real issue.

Theft and fraud are serious issues with investing in cryptocurrencies.

Be careful before investing in cryptocurrencies, and only make sure you are putting your money in reputable bitcoin wallets.

Trading Cryptocurrencies

If you want to know how to make money off crypto without investing, then trading is a great option.

Some people use the terms “investing” and “trading” interchangeably, but they are entirely different. Investment is a long-term endeavor, while trading seeks to achieve short-term goals.

You will find trading at the helm of most ‘how to make money with cryptocurrency’ lists, but it is not as easy as it sounds. Trading in cryptos requires experience and skills.

To succeed, you must have in-depth knowledge and understanding of blockchain and various projects. Even though this is not required, it is necessary!

By being knowledgeable, skilled, and experienced, you will be able to understand the price action of different cryptocurrencies in the historical context and use that to predict future prices on a short-term basis.

Making money with cryptocurrency through trading requires investors to either buy and sell actual cryptos or use derivatives like contract for difference (CFD).

When you trade-in crypto using CFD, you can speculate the direction of crypto assets’ prices without owning them. CFDs provide a perfect opportunity for traders to make profits from bearish and bullish price movements in underlying digital currencies.

Pros of Trading

Trading in digital currencies has many benefits, including:

High liquidity

Trading in cryptocurrencies, especially using CFDs, allows you to trade on margin, hence providing you with easier execution and greater liquidity.

Finite supply

There is a limit on the number of cryptocurrencies that can be in circulation. Each coin created slows down the creation of another, and the creation process halves after a few years.

This means that the value of cryptocurrencies will continue to rise, and this is good news for traders.

Potentially lucrative money maker

There are people who see chaos in cryptocurrencies, but prudent traders see opportunity.

Due to their volatility, you can easily buy them when the prices are low and sell them when they are high.

Cons of Trading

Some of the disadvantages of trading include:

Security issues

Due to lack of regulatory compliance, trading in cryptocurrency is susceptible to scams and frauds.

High price fluctuations

Short-term fluctuations are bothersome to traders. The high price volatility of cryptocurrencies makes it challenging for people to use it as a legit form of exchange.

Staking & Lending

If you have previously searched ‘How to make money with cryptocurrency’ on a search engine, staking and lending have probably popped up.

Staking and lending are arguably some of the best ways of making money with altcoins. Staking means locking coins in a crypto wallet and receiving rewards in order to validate transactions on a proof-of-stake network (PoS).

Instead of mining, the algorithm of this network selects transaction validators based on the number of coins committed to the stake. What makes PoS better than mining is because it requires less-expensive hardware.

Additionally, it is more energy-efficient. Cold staking is another way of making money trading cryptocurrency. Here, investors stake coins while holding them in a safe offline wallet.

While staking, you basically lend coins to a network to verify transactions and maintain its security. You can also lend coins to other investors and generate money through interests.

Many platforms facilitate crypto staking and lending, including decentralized finance (DeFi) applications, peer-to-peer lending platforms, and exchanges.

Pros of Staking and Lending

- Less expensive: when compared to mining, staking and lending don’t require a huge investment in hardware.

- A faster way of earning with crypto: The interests and rewards accrued through crypto staking and lending can be transferred and withdrawn on a daily basis.

Cons of Staking and Lending

- Security concerns: staking and lending are also susceptible to theft and fraud.

- Critical failure losses: If a user losses control of private keys to his wallet, funds can be lost or seized without them having a chance of recovery.

Mining Bitcoin

Mining Bitcoin is a great way to make money with bitcoin. Mining is a critical component of the Proof of Work (PoW) consensus mechanism and one of the oldest ways of making money with cryptocurrency.

It is a process of securing the proof of work network and verifying transactions.

Miners are given new coins through block rewards for successfully completing these functions.

In the past, miners could easily mine bitcoin on a desktop computer, but today, sophisticated hardware is required to achieve this.

Pros of Bitcoin Mining

Some of the benefits of bitcoin mining include:

You can actually make money

One of the biggest benefits of bitcoin mining is that you can make money. Even though money is a motivating factor, you should be cautious before diving into bitcoin mining.

Ensure you understand how to do it, and you have the right equipment to mine the right coins.

Mining is getting more affordable

At the beginning of 2018, Bitcoin mining difficulty dropped by a whopping 15%. This trend keeps happening every year due to a large number of miners quitting.

Even though you may need to incur some costs to purchase the hardware needed, the drop in the cost of mining means you can enjoy more profits.

The rise of cloud mining

One benefit of bitcoin mining is the rise of cloud mining. It lets you mine bitcoins without shelling out on pricey hardware and extortionate power bills.

Hardware retains value

In case you choose to call it quits and focus on other ways of making crypto profits, you can still make a significant amount of money by selling your bitcoin mining hardware.

Cons of Bitcoin Mining

It’s not all fun and games, as there are some minor drawbacks of bitcoin mining. Here are some obstacles you might find:

Complexity

Bitcoin mining is not as easy as it sounds. Even those with in-depth knowledge and understanding of blockchain networks might find this undertaking overwhelming.

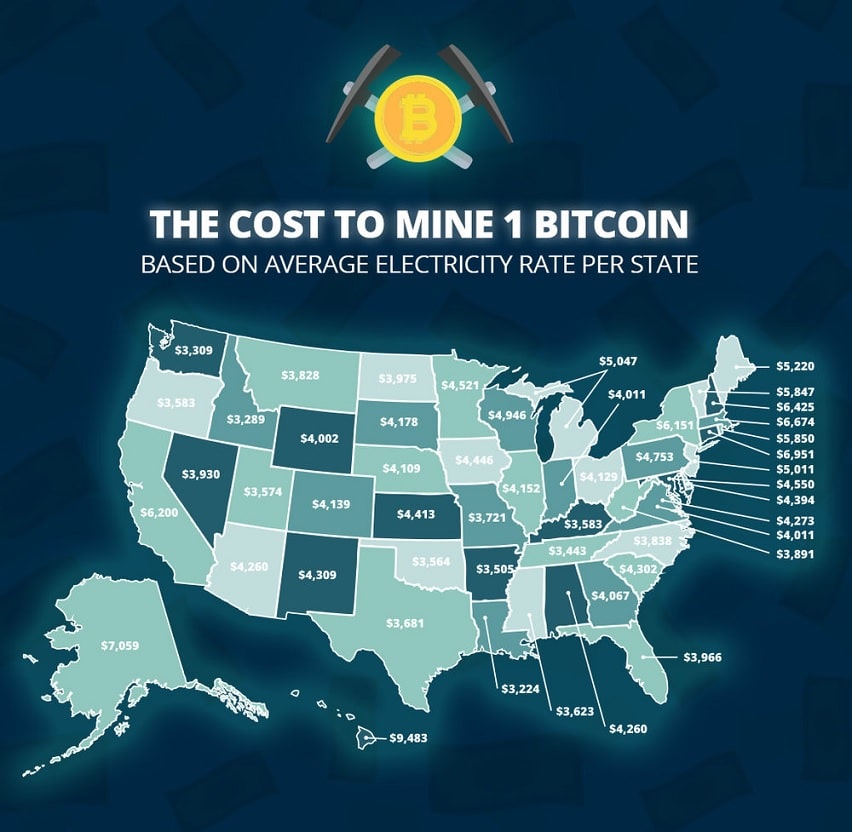

Electricity costs

If you want to mine bitcoins, make sure you understand what you are getting yourself into because you will part with hundreds of dollars in electricity bills.

Hardware costs

Mining hardware is too expensive, even though it retains its value.

Day Trading

Day Trading is one of the most commonly used cryptocurrency trading strategies. It involves entering and exiting positions on the same trading day.

This strategy is also known as intraday trading since the trading happens on the same day.

The main goal of day traders is to use various intraday trading methods to try and make a profit out of price changes in cryptocurrency.

Successful day traders have experience and have a deep understanding of the market. They use technical analysis to generate trade ideas.

They also use volume price action, technical indicators, and chart patterns to determine entry and exit points for trades.

As with any other trading strategy, risk management is critical in fruitful day trading.

Pros of Day Trading

24/7 market access: crypto markets are open 24/7

- Unsophisticated: Even though there are many professional traders participating, trading is not sophisticated, and experienced traders have an edge.

- Volatility: Swings in crypto prices offer day traders a wide range of opportunities to get more profit.

- Regulation (or lack thereof): Most exchanges don’t enforce account verifications, and this provides traders with a plethora of opportunities to make money.

Cons of Day Trading

- Lack of regulations meaning there is no authority to intervene in case of a dispute.

- Day trading carries a high risk, and there is never a guarantee that you will make money.

- Day trading is expensive. You need the right hardware and software, as well as ample financial information that will help identify entry and exit points.

Crypto Social Media

Another way to make money with cryptocurrency is through crypto social media. In 2016, Dan Larimer launched the first blockchain-based social media platform known as Steemit.

This is a platform that rewards users with the native coin, STEEM, for developing and curating content. This platform run into issues in 2017, and the number of users has declined since then.

However, there are many other platforms that have been developed on this idea of rewarding users for creating content. Some of them include Scorum, Sapien, and Narrative.

Pros of Crypto Social Media

- You don’t just make money. You also develop mutually beneficial networks with like-minded people.

- Finding people to trade with is super easy.

- You don’t need to invest in expensive equipment to start trading.

Cons of Crypto Social Media

- There is a high risk of meeting with scammers and fraudsters

- There is no guarantee that you will make money through these platforms.

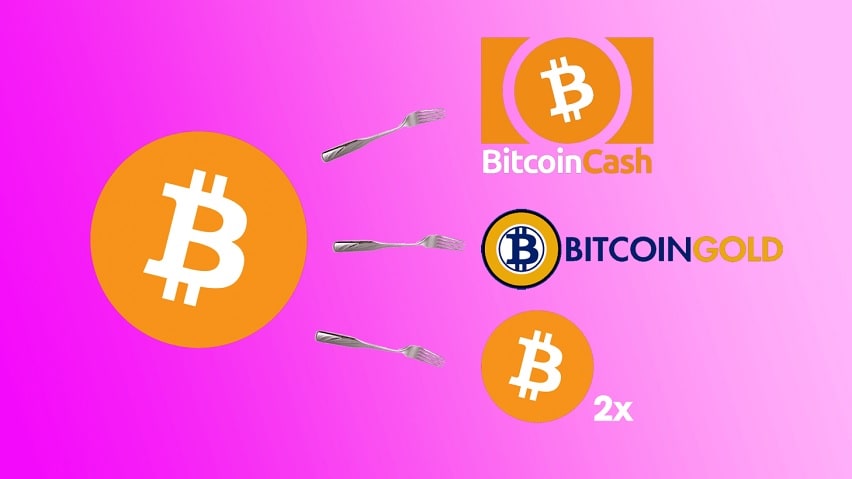

Airdrops and Forks

What are Airdrops and Forks? They are equivalent to being in the right place at the right time.

The first ones are free tokens that are distributed by an exchange to create a larger user base for a project by generating awareness.

Meanwhile, When a blockchain forks, those who hold coins on the original chain are given free tokens on the new network.

For those who want to learn how to make money with cryptocurrency, Airdrops and Forks are ideal.

Pros of Airdrops and Forks

- You don’t need to make a huge investment to make money from airdrops and forks.

- Making money through airdrops and forks doesn’t require much time or energy.

- You don’t need sophisticated equipment to earn rewards through Airdrops and Forks.

Cons of Airdrops and Forks

- There is no guarantee of making money.

- There are high risks of falling victim to scams and other fraudulent activities.

Can You Get Rich With Cryptocurrency?

Even though it is possible to make money with cryptocurrencies, it is not that easy. Searching for things like ‘how to get rich with cryptocurrency‘ will not help you get rich with cryptocurrency.

To make the best out of it, you need to do deep analysis, attain great skills, get rich experience, and use this article as a guide!

Conclusion

Today, crypto has integrated into the mainstream financial and commercial systems, and it can achieve everything that traditional currency can do.

The innovative nature of cryptocurrency means you can use it to generate wealth in many innovative ways.

With all the ways on how to make money with cryptocurrency outlined above, there is no reason why you should not join the bandwagon of celebrated cryptocurrency moguls.

Plus, as mentioned, there are numerous tools that make the job easier for investors and traders. One of the best ones is Tezro.

Tezro is not only a fully encrypted message app that reduces the risk of security breaches but also has the feature of exchanging crypto assets.

Also, it incorporates tons of cryptocurrencies, such as Bitcoin and Ethereum. Read more about all Tezro features.