What is the best crypto investment strategy? This is one of the questions that repeatedly echo through the halls of every cryptocurrency investment platform.

This is a genuine question considering that the cryptocurrency space is often considered merciless.

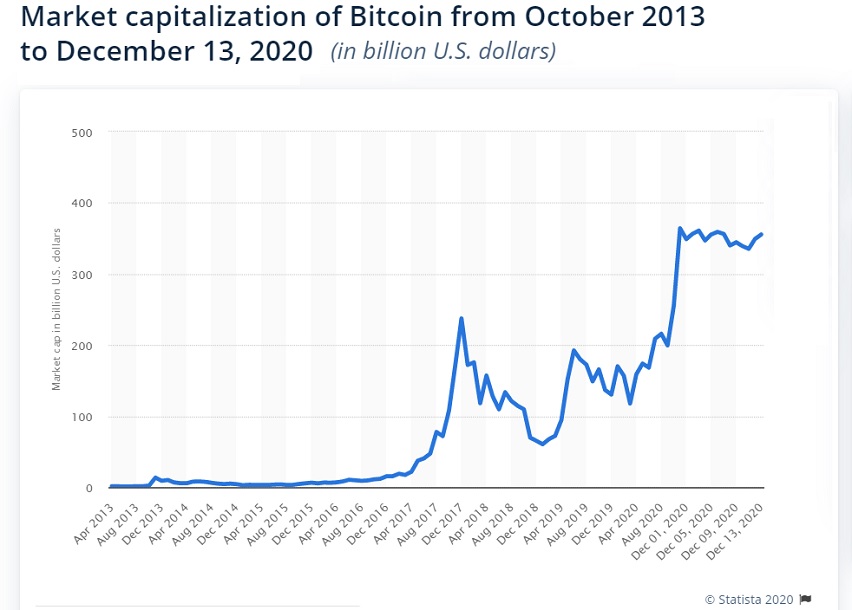

This reputation is a result of the unforgiving experience of thousands of early-stage investors during the euphoria in the crypto market towards the end of 2017.

Driven by greed and FOMO’s – fear of missing out – feeling, these groups of investors entered the market without even knowing what cryptocurrency was.

They bought lots of bitcoins and other altcoins that had created a buzz on the web.

This action by investors resulted in the development of a bubble around bitcoin, and its price hit an all-time high of $20,000! However, this bubble burst in 2018, and these investors ran into significant losses.

Therefore, before you choose to invest in any crypto, you need to understand the best cryptocurrency investment strategies and use your judgment to determine the one that will work great for you.

Without a doubt, the cryptocurrency market is seen with great expectations for its future.

For you to maximize your returns in future investments, below are some of the best Bitcoin and Ethereum investment strategies you should know.

Long-term Investment

Long-term investing in cryptocurrency is a great crypto investment strategy that shouldn’t be overlooked. It requires buying Bitcoin and Ethereum, then storing them in a secure wallet.

Often, long-term crypto investing involves making a buying decision that is based on long-term and fundamental trends.

The goal is to ultimately sell your cryptos at a significantly higher price than the one you bought it. This strategy is often used by beginner investors since it is simple and easy-to-execute.

Does HODL guarantee profits? Factually, there is no definitive answer on whether long-term investing is the ideal crypto investment strategy for new and experienced investors.

This is because this strategy only when you are able to hold onto your asset until the market prices go up.

Long-term investments are sometimes considered unprofitable because it leaves no chance for maximizing returns when the market goes down.

By sticking to this strategy, you may miss out on some opportunities brought about by other strategies that we will discuss later in this post.

Before deciding to use long-term investing as your cryptocurrency investment strategy, it is imperative to understand whether the coin you are buying is undervalued or overvalued.

Also, since price volatility can and will occur, you need to ride out upturns and downturns and only focus on making profits.

Pros of HODL

- HODL has been proven to return exponential gains on invested capital, especially during uptrends.

- It is one of the simplest cryptocurrency investment strategies that can be used by newbies in the crypto world.

Cons of HODL

- It is not effective during downtrends.

- It can lead to exponential losses.

- HODL is not nuanced enough.

Smart Holding

Smart holding is an intermediate to long-term approach to the crypto marketplace. The typical duration of this strategy is measured in years, months, and weeks.

The main goal of this crypto investment strategy is to capitalize on a strong trend.

Entering and exiting the market efficiently, as well as identifying opportunities with adequate risk vs. reward ratios, are integral to the success of smart holding.

In smart holding, you can decide the schedule for buying an asset. You can do so daily, weekly, bi-weekly, monthly, etc.

There are two averaging strategies used in this approach, as shown below:

Dollar-cost Averaging (DCA)

This is a practice where an investor allocates a particular amount of money at regular intervals shorter than a year (mostly monthly or quarterly).

This strategy may include things such as automatic deductions from your paycheck. It is highly effective for investors with lower risk tolerance.

Value Cost Averaging

Investors who rely on this strategy aim at investing more when the crypto price falls and less when the price rises.

This method is highly flexible and allows you to choose when to buy assets.

Pros of Smart Holding

- It’s one of the most affordable cryptocurrency investment strategies.

- It allows you to choose when to buy assets; thus preventing cases of bad timing.

- Allows you to buy assets in small installments; therefore, it minimizes risks and maximizes profits.

Cons of Smart Holding

- May lead to lower returns.

- Not effective for new investors.

Cryptocurrency Trading

Cryptocurrency trading often involves speculating on the price movements through a CFD trading account or buying and selling the underlying cryptos via an exchange. This form of online trading is almost similar to trading stocks, commodities, or currencies.

The only difference between crypto trading and others is the high volatility. Most traders, especially newbies, want to get huge profits. With stock trading, for instance, you need to wait for months or years to achieve this.

Cryptocurrency, on the other hand, provides a higher speed of getting returns.

Where Do You Start With Crypto Trading?

The most important thing you need to remember is that it is challenging and nearly impossible to start successful crypto trading without any experience.

If you want to invest in cryptos, you need some basic knowledge. Below are a few things you need to learn:

Analyzing Cryptos

Do you want to invest in Ethereum or Bitcoin? Make sure you understand each coin and how popular it is. When you finally choose the coin, you believe will maximize your profits, choose safe storage.

It is recommended that you find a wallet of high quality, like Tezro.

Using Charts and Quotations

You will need to study market dynamics, and this means you will need to learn how to use charts and quotations.

Opening Deals on Crypto Exchanges

Crypto exchanges provide investors with more opportunities to generate income through cryptocurrencies. We will discuss exchanges later in this article.

What Is CFD Trading On Cryptocurrencies?

One of the most sought-after Bitcoin investment strategies is CFD trading. CFD trading is basically derivatives that enable an investor to speculate on cryptocurrency price movements without having ownership of the underlying assets.

Investors can go “buy” if they think the cryptocurrency prices will shoot or can go “sell” if they think the prices will go down.

Both “buy” and “sell” are leveraged products, and all investors need to do is put up a small deposit known as margin so that they can get full exposure to the underlying market.

Pros of Cryptocurrency Trading

- Offers high opportunities for getting income.

- Investors can start trading with minimal investments.

- Through CFD crypto trading, you can trade in any direction – buying is just as accessible as buying.

- In cryptocurrency trading, you don’t need to have an exchange account to use a special wallet.

- Crypto trading is available 24/7. You can trade whenever you want!

- Secure store of value.

- Universal accessibility – you can access it from any region or country.

Cons of Cryptocurrency Trading

- You cannot engage in cryptocurrency trading without adequate knowledge.

- No guaranteed profits.

- Trading in cryptos comes with a certain degree of risk.

Mining

Cryptocurrency mining is a process whereby transactions between users are verified and added to the blockchain ledger.

The mining process is not only used as a source of income but is also responsible for introducing new coins into the current circulating supply.

It is one of the major elements which permit cryptos to work as decentralized peer-to-peer networks, without the need for control from a central authority or third-party.

Mining is mostly used as a bitcoin investment strategy because bitcoin is regarded as the most popular mineable cryptocurrency. Mining bitcoins is dependent on a consensus algorithm known as Proof of Work.

Crypto mining is costly, painstaking, and sporadically rewarding. However, it is one of the few cryptocurrency investment strategies that have a magnetic appeal for many investors.

This is because miners are rewarded for their hard work with cryptocurrency tokens.

Through mining, investors can earn cryptocurrencies without having to put down money for it. Mining rewards are given to the miners who discover solutions to complex hashing puzzles first.

The probability that you will be the first to find a solution is directly related to the portion of total mining power on a particular network. You will need to invest in Application-specific Integrated Circuit (ASIC) or Graphics Processing Unit (GPU) to set up a mining rig.

Pros of Cryptocurrency Mining

- You can make money through cryptocurrency mining.

- Mining is getting cheaper- this is mostly due to the high number of miners who quit due to the crypto crash and the introduction of cloud-based mining.

- Hardware retains value-if you want to quit mining, you can still sell your hardware and make a significant amount of money.

- You don’t just make money. You help crypto grow- through mining, you help cryptocurrency become more mainstream. Plus, you contribute to the long-term success of cryptocurrency.

Cons of Cryptocurrency Mining

- Complexity- getting started is not easy. Even experts in blockchain technology get bamboozled when starting. At the very minimum, you need mining software, a coin wallet, an account with a crypto exchange platform,

An ASIC chip or a GPU, cooling equipment, and more. Getting all these things up and running is not easy! Be prepared to read lots of guides and make mistakes before getting it right! - Electricity costs- Mining cryptocurrency is electricity-intensive. In fact, ecologists believe that this process is having an adverse effect on the environment at an alarming rate.

- Hardware costs- buying the impressive array of mining hardware required will cost a significant amount of money.

- Scams- the crypto space is awash with scams, most of which affect the mining industry.

- You could lose a lot of money- you can make money mining cryptocurrencies, but this is not guaranteed. You could lose money too.

Exchange

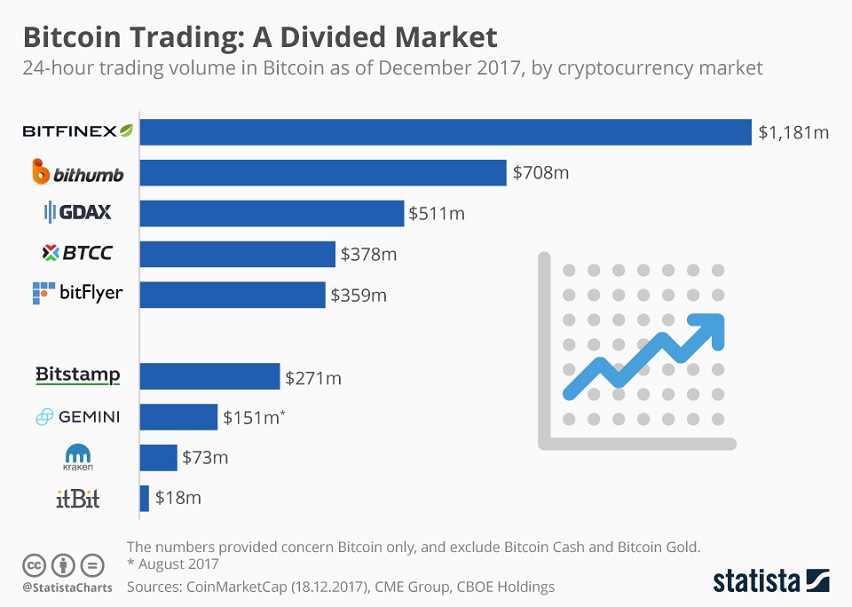

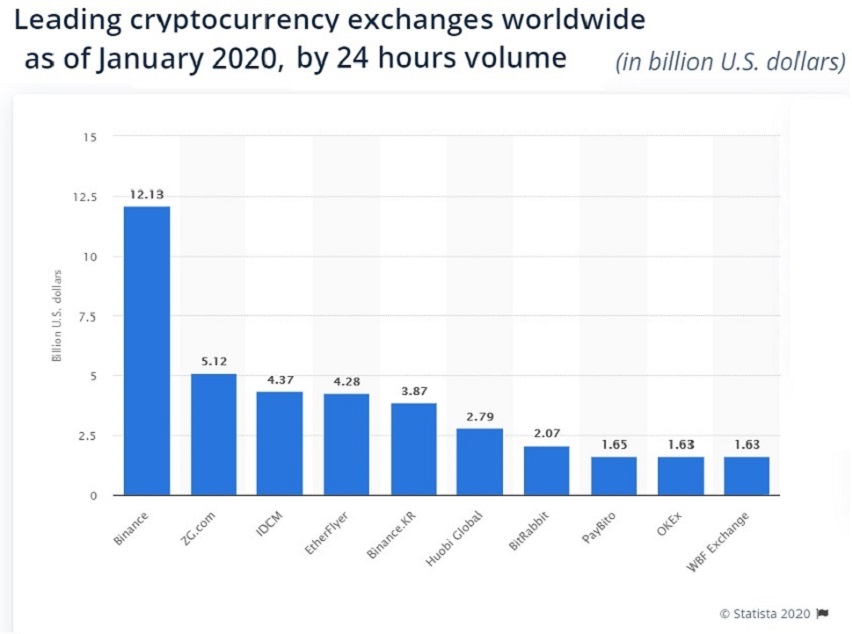

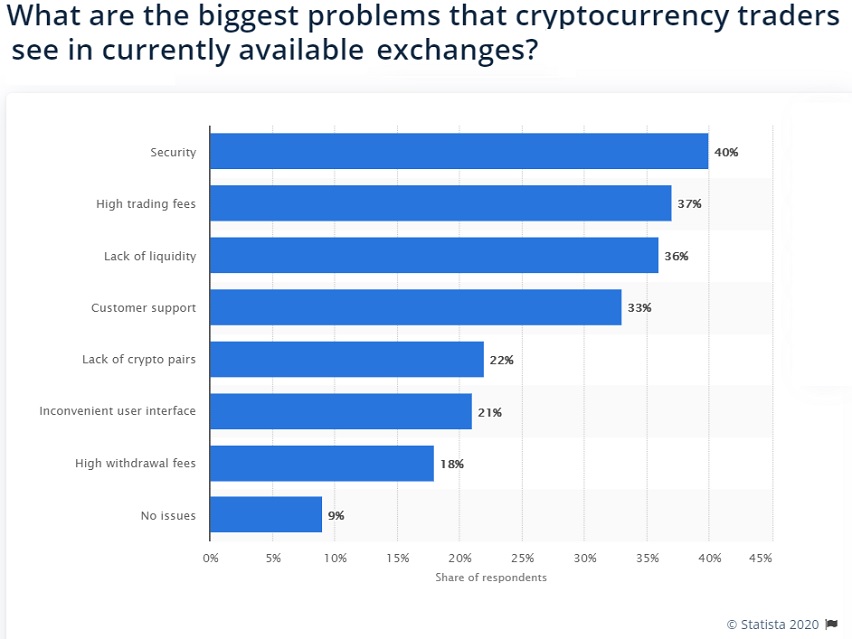

A cryptocurrency exchange is a digital marketplace where investors buy and sell digital assets using different altcoins or fiat currencies.

An exchange is basically an online platform that acts as an intermediary between buyers and sellers of the cryptocurrency.

Cryptocurrency exchanges match buyers and sellers. Just like the traditional stock exchange, traders can buy and sell digital coins through a limit order or market order.

When a limit order is set, the investor directs the exchange to trade coins at a price above the current bid or lower than the current ask, depending on whether they are selling or buying.

After a market order is set, the investor authorizes the exchange of their coins at the best prices available in the online market place.

To make money through an exchange, an investor must register with the exchange and undergo a series of varication steps to authenticate his/her identity.

Once the authentication is done, the account is created, and the user can transfer funds to the account before purchasing coins.

Pros of Bitcoin Exchange

- You can actually make money

- When the prices are good, you can make instantaneous profits

- There are lots of exchanges and currencies to choose from

- High-security standards- most exchanges guarantee security to investors’ digital assets

- Established reliability and trust

Cons of Bitcoin Exchange

- You need capital to start trading in an exchange platform;

- There are pretty high exchange fees involved.

FAQs

What Do I Need To Start Investing In Cryptocurrencies?

To start investing in cryptocurrencies, you need to have a few things. They include:

- Basic information about the cryptocurrency you want to invest in.

- A digital wallet.

- A secure connection to the internet.

- A method of payment, such as debit cards, credit cards, and bank accounts.

- An account with a cryptocurrency exchange.

How Do I Choose A Cryptocurrency To Invest In?

Before choosing a cryptocurrency to invest in, you need to consider the following factors:

- Market cap: Market cap ensures liquidity and highly liquid coins perform better.

- Popularity: How popular and useful a coin is.

- Valuation: Make sure you research the valuation of a coin to ensure it is not overpriced.

- Competitors: What does the coin stand when compared to its competitors? This is a question you should answer before choosing the best coin.

- Demand-supply: Ensure the coin you choose has a higher demand than supply. A rise in demand ensures a rise in value.

Are Gains From Cryptocurrency Investments Taxable?

In some countries, the gains from cryptocurrencies are taxable. Therefore you may need to check with your tax authority before investing in these digital assets to avoid future problems.

Is Cryptocurrency Investing Worth It?

Cryptocurrency has higher liquidity than other investments. This means that you can make money quickly with cryptocurrencies than with gold, fiat currencies, and traditional stocks.

Cryptos are scarce, meaning their value will keep rising. As an investor, you need to do your due diligence and find the best coins to invest in. As long as you choose the best investment strategy, there is no reason why you shouldn’t make a kill from cryptos!

Key Takeaways

- A long-term investment is ideal for starters in the cryptocurrency world.

- Even though mining is rewarding, it requires more time, effort, and resources. You need to invest a lot in hardware and software before you start mining.

- Gains from cryptocurrency are taxable in most countries. Make sure you check with your local authorities before investing so that you don’t find yourself on the wrong side of the law.

Conclusion

Investing in cryptocurrency is one of the best decisions you can make. Even though there are some risks present in the crypto market that are not prevalent in traditional financial markets, such as bonds and stocks with high volatility, cryptos are generally safe and have the potential for higher returns.

Over time, more individuals and bigger companies will add cryptos in their portfolios, and the volatility danger will lessen. By investing in tokens today, you are likely to be richly rewarded in no time.

Make sure you do research and choose the best crypto investment strategy to maximize your chances of success. Download Tezro now to start exchanging your cryptocurrencies in a completely safe and encrypted app!