The reason why you want to learn some cryptocurrency terms is because you understand that cryptocurrencies are becoming more and more popular each year. In fact, some experts believe that they’ll eventually replace traditional currencies like the dollar or euro.

Cryptocurrency has, without a doubt, taken the world by storm in recent years and it’s showing no signs of slowing down anytime soon. large companies like Tesla and renowned payment systems like PayPal have adopted cryptocurrency as a form of payment.

With cryptocurrency becoming more and more mainstream, it’s important that you have a grasp of crypto terminology.

If you’re looking for a quick guide on crypto terms that will help you navigate your way through this brave new world then keep reading!

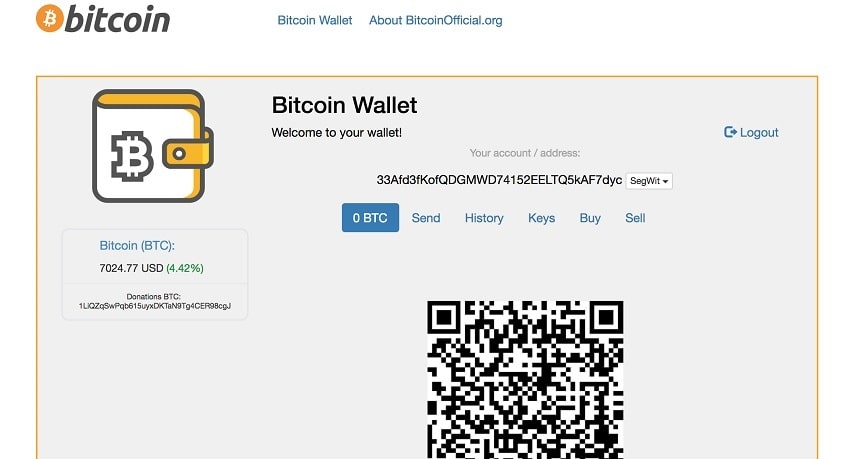

1. Address

The address is a unique string of numbers and letters that you’ll use to send, receive or store a cryptocurrency. Think of your address as an email address but for cryptocurrencies instead. Unlike your email address, a crypto address is not something you can easily memorize. That’s why cryptocurrency experts recommend that you write down your addresses on a piece of paper and store it in multiple secure locations.

The address is also one of the most important crypto terms that you need to know! That’s because every time someone sends you cryptocurrency, they’ll use your address so make sure it stays private.

Address Example: 23EaBcDeFgHiJkd89FGsghi789GDEZ21

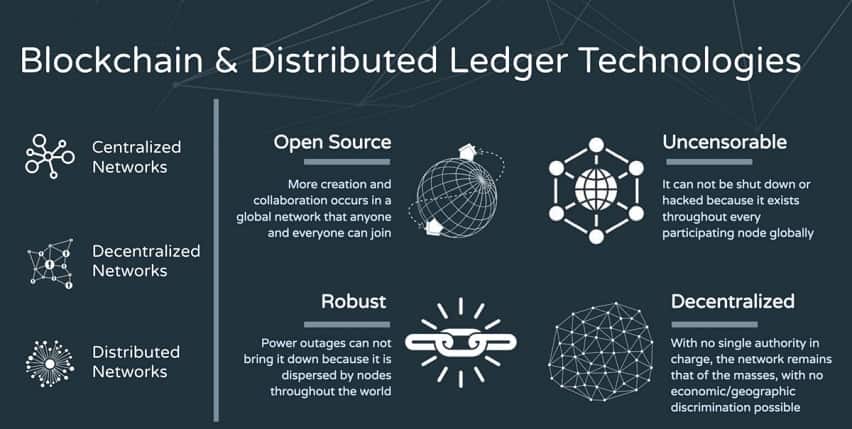

2. Blockchain

The Blockchain is essentially an online ledger where cryptocurrencies are stored after transactions have been processed. Most Blockchains are open source which means anyone can access them for free. However, there are some rare exceptions like Hyperledger Fabric that require permission before users can enter the database.

Some experts believe that Blockchain will revolutionize industries outside of just finance by helping companies increase transparency with their data while simultaneously speeding up transaction times across various verticals, including healthcare and government operations.

3. Altcoins

Altcoins are any cryptocurrencies that aren’t Bitcoin. While most people associate cryptocurrencies with Bitcoin, they’re not the only game in town. There are actually more than a thousand different altcoins that have been created over time and each one is unique in some way from its counterparts.

For example, there’s Litecoin which was designed to improve upon several of Bitcoin’s shortcomings while Ethereum works as a platform where decentralized applications can be built on top of it using smart contracts.

4. Cryptocurrency

A cryptocurrency is a form of digital money that can be used to buy things online or converted into traditional fiat money.

Unlike traditional currencies, you can’t store cryptocurrency in your bank or pocket. Instead of having a physical object like dollar bills or coins, cryptocurrencies are actually stored on the Blockchain which is why they’re referred to as digital currencies.

If you want to hold onto your crypto then one option is to use an online wallet that will let you access your funds from anywhere in the world at any time with just an internet connection and username/password combination.

However, most experts recommend using hardware wallets over software wallets because they offer better protection against hackers who might attempt to steal private keys off their target’s computer systems by using keyloggers and other types of malware.

5. Decentralized apps

These are apps that can be built with Blockchain technology and run without third parties getting in the way.

For example, a decentralized app could potentially allow people from all around the world to contribute files or edit content online by using their smartphones instead of having to rely on employees who work at a central company headquarters like they do now for many popular apps such as Google Docs.

In fact, some experts believe that it’s only a matter of time before we see an entirely new breed of apps rise up thanks to cryptocurrency and Blockchains, which will disrupt major industries in unprecedented ways when it comes to how data is managed and processed every day!

6. Decentralized finance

Decentralized finance is a way of describing financial applications, products and services that are built with the Blockchain as a base.

In other words, decentralized finance is any app or platform where transactions occur between peers without having to rely on third parties like traditional banks. One example would be cryptocurrency exchanges which let users buy and sell coins from each other instead of going through middleman sites.

Another popular option is peer-to-peer lending platforms where you can borrow money directly from individual lenders from all over the world instead of waiting for bank approvals or relying on one specific person who might only have so much capital to lend out at once!

7. Digital Currency

This is a form of currency that only exists in digital form. It doesn’t have a physical counterpart and is not controlled by central banks.

Since no one entity controls it, the value of digital currency fluctuates based on its own market conditions rather than those controlled by another company or government. It’s also decentralized so anyone can use it to buy things online without having to go through financial institutions. Simply put, decentralization means that people have full control over their money!

8. Distributed Ledger Technology

This is one of the most common crypto terms that refers to a way in which data is recorded and shared across different nodes in a peer-to-peer network.

Unlike traditional ledgers that are typically housed in centralized locations, distributed ledger technology makes it possible for records to be held by multiple parties so there’s no need for any party to have full control over what happens with the data being maintained.

Once changes are made to the ledger, they’re reflected across all nodes in an almost instant fashion.

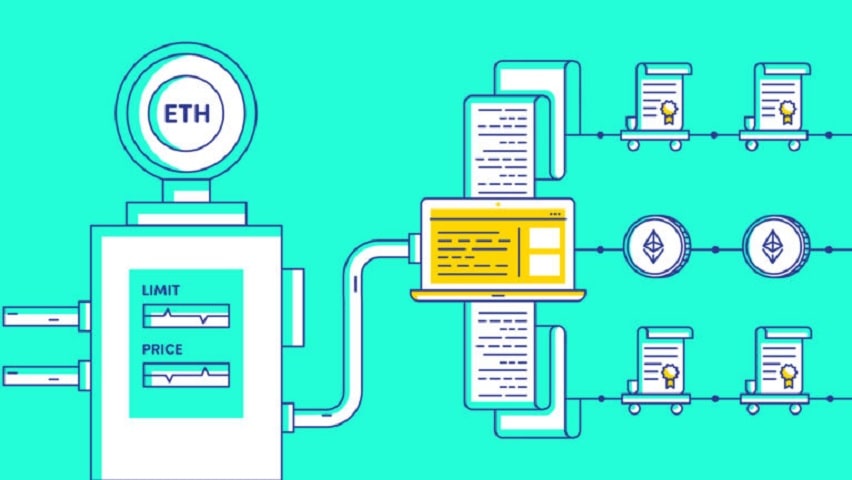

9. Gas

Gas is a crypto lingo used to refer to the internal transaction pricing mechanism used by Ethereum. It’s paid by users to miners on the Ethereum network in exchange for the computing power used to confirm transactions.

Each operation that occurs on the network has its own gas price which goes towards paying for all of the computations taking place around it. As you might imagine, this is useful to keep track of how much processing power a specific action requires so people know what they’re getting into before deciding to make any transactions!

10. Mining

Mining is one of the top crypto slangs that you might have come across even if you don’t consider yourself an active crypto enthusiast. It refers to the process of validating transactions that are recorded on a Blockchain.

In order to conduct the verification, miners need access to powerful computers that run specialized software and solve complex mathematical problems as fast as possible in exchange for rewards such as Ether tokens or Bitcoin.

While this may sound simple enough from one perspective, it’s actually pretty complicated because you have to make sure that all nodes across the network agree with what is being done at any given time! Learn about cloud mining too here.

11. Non-fungible tokens

Non-fungible tokens, or NFTs are tokens that have unique properties, characteristics, or attributes which make them different from others. Unlike fungible assets like Bitcoin where every unit is the same as any other, non-fungibility means that each individual token has its own value based on what it can do.

Take for example CryptoKitties which are one of the most popular examples of NFT platforms in action! Every cat created by users will be completely unique and there’s no way to trade it without first giving up control over ownership rights because you could end up with a less valuable copy if someone else buys your kitty (or vice versa).

If you ever come across an asset type like this in real life, make sure to track all their unique qualities to keep yourself safe! NFTs are also related to crypto art as you can read here.

12. Satoshi Nakamoto

This is a cryptocurrency terminology you cannot ignore when talking about crypto terms. It is the name used to refer to the creator(s) of Bitcoin.

Satoshi Nakamoto is a pseudonym that could be an individual person or group working closely together to bring the idea of digital currency into fruition in 2008 when it was first introduced!

While there has been plenty of speculation about who this figure might actually be, nobody knows who he is, even he (they) is credited with being one of the most important figures in crypto history!

Learn more about Satoshi here.

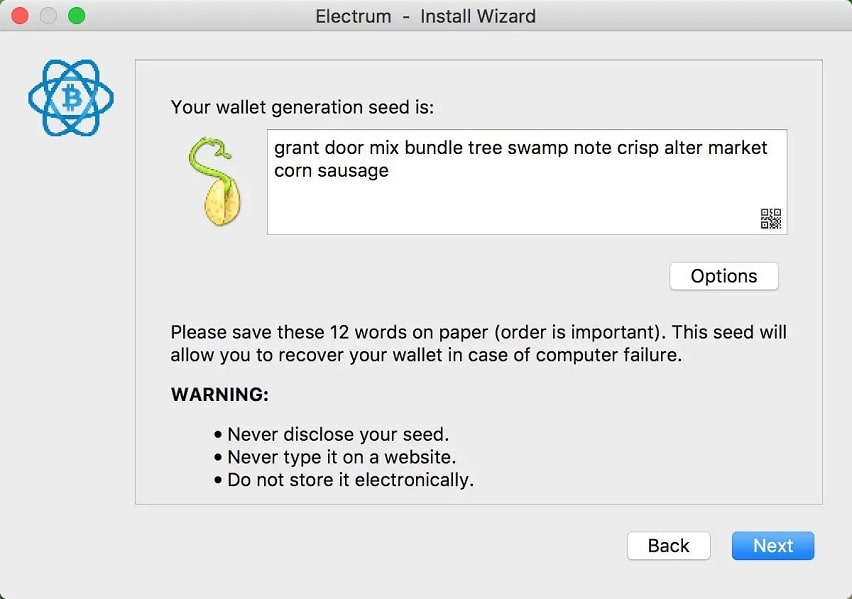

13. Seed Phrase

Seed phrases are 12-word combinations that can be used to recover any crypto assets associated with a specific wallet. If you ever misplace your private key, having access to the seed phrase is vital for keeping all of your funds safe!

When creating this type of code, it’s important to make sure that they’re not stored electronically in case something happens so only you know where they’re located (keeping them written down on paper or even memorized would work too!) This ensures that nobody else will end up stealing your money if there’s no way around it which is why many people choose this route when setting up their wallets.

14. Wallet

A crypto wallet is a type of software or hardware that stores public and private keys for sending or receiving tokens on the Blockchain.

There are several different types of wallets available to users which vary in their number of features as well as how they’re used to access funds!

Generally, a wallet is defined by its ability to store your personal information securely without having anyone else gain access to what you’ve set up with it. In this way, cryptocurrencies can be spent even if there’s no internet connection available because all details needed will be stored within the wallet itself.

You can check out the best crypto wallet apps here.

15. Whale

A whale is someone with a significant amount of cryptocurrency assets in their possession.

In the crypto world, whales are usually able to play an important role when it comes to affecting price points on exchanges because they can easily manipulate how prices move through simple trades! While this may sound bad at first glance, having these market movers around actually helps keep things stable and make sure that users don’t lose money from sudden changes or crashes that could happen if there were no larger players involved.

Key Takeaways

- Getting informed and knowing crypto terms is the best way to avoid getting into pump and dump schemes;

- By reading more articles on blogs, like the one from Tezro, you will get more familiar with the crypto lingo;

- Cryptocurrency is here to stay, so even if you don’t mean to invest you should get acquainted with it and have knowledge on how it works.

Final Thoughts

These crypto terms are just the beginning of everything you’ll need to know before getting into the crypto space. You should read more and get informed before advancing with the purchase or investment in any crypto.

We hope that this article helps provide some clarity on these concepts as you continue to work towards achieving your goals with cryptocurrency.

Make sure you understand each and every definition so you can set yourself up for success and avoid having to worry about any unnecessary confusion along the way!

Download Tezro app and start trading and buying crypto with complete security in a fully encrypted platform.