Having multiple crypto wallets is one of the most advantageous steps for securely managing cryptocurrencies, as it allows users to store and access their digital assets in multiple wallets simultaneously. This increases the security of your funds’ security and gives you more control over how much money is stored in each wallet.

So, the questions remain – how many crypto wallets are there? How many should you have? In this article, we’ll explore these questions in detail and provide you with the information you need to make an informed decision about your crypto wallet strategy.

Types of Cryptocurrency Wallets

There are different types of cryptocurrency wallets. They include:

Software Wallets

A software wallet is a downloadable application that allows you to store, send and receive cryptocurrencies on your computer or mobile device. They are often the most user-friendly of all types of wallets but may not be as secure as hardware wallets.

Software wallets are divided into two categories: hot wallets and cold wallets. Hot wallets are software wallets that are connected to the internet, while cold wallets are offline wallets that are not connected to the internet.

Hot wallets are generally considered to be more convenient than cold wallets because they are easier to access and use. However, they are also more vulnerable to hacks and other security risks because they are connected to the internet. On the other hand, cold wallets are more secure because they are offline and not susceptible to online attacks.

Hardware Wallets

So, what is a hardware wallet? A hardware wallet is a physical device that is specifically designed to store and manage cryptocurrencies in a secure way. It is called a hardware wallet because it is a physical device that you can hold in your hand, similar to a piece of hardware.

Hardware wallets are generally considered the most secure type of cryptocurrency wallet because they store your private keys offline and are not connected to the internet. This makes them resistant to hacks and other online attacks.

Hardware wallets are typically small, portable devices that you can connect to your computer or mobile device using a USB cable. To use a hardware wallet, you will need to create a wallet and receive a unique address that you can use to send and receive cryptocurrencies. You will also need to set up a PIN or password to access your wallet and sign transactions.

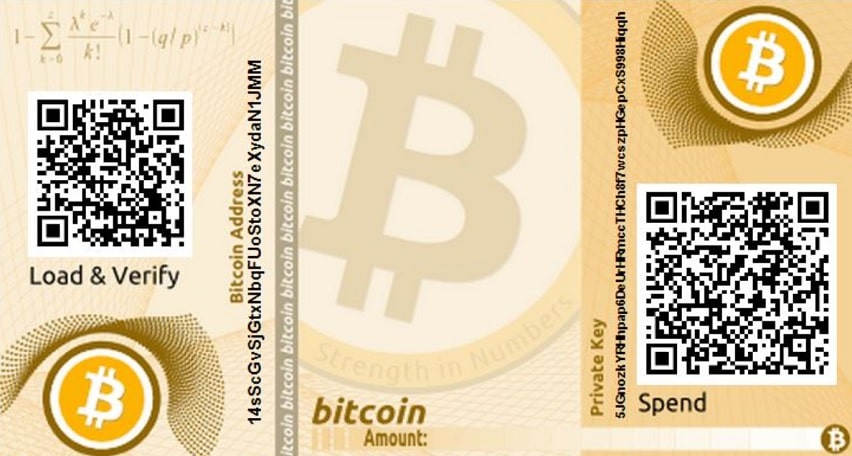

Paper Wallets

What is a paper wallet? A paper wallet is an offline storage method for cryptocurrencies. It consists of two parts – a public address and a private key – printed onto a physical piece of paper or other material.

Paper wallets are one of the most secure ways to store cryptocurrencies because they are not connected to the internet, and your private keys never leave the paper wallet. This makes them resistant to hacks and other online attacks. Additionally, paper wallets are easy to use and store, making them an ideal option for those who don’t have access to a hardware wallet or software wallet.

Benefits of Holding Multiple Crypto Wallets

Some of the benefits of holding multiple crypto wallets include:

Increased Security

By having multiple wallets, you can spread out the funds across different wallets and increase the security of your digital assets. This is because if one wallet is compromised, the funds stored in other wallets will remain safe.

Improved Control

Having multiple wallets gives you more control over how much money is stored in each wallet. You can also keep certain funds separate from others, giving you better control over your cryptocurrencies.

Better Organization

If you hold multiple crypto wallets, you can easily organize and track the funds in each wallet. This makes it easier to manage your digital assets, as you can easily see which wallet holds which funds.

Disadvantages of Holding Multiple Crypto Wallets

Some of the drawbacks of holding multiple crypto wallets include:

Increased Maintenance

Having multiple crypto wallets requires more time and effort to maintain, as you need to make sure they are all secure and up to date. Additionally, if you use different wallet providers, you may need to pay fees for each wallet.

Increased Risk of Loss

Holding multiple crypto wallets also increases the risk of losing your funds. If you lose access to one wallet, or if it is compromised, then you may lose all the funds stored in that wallet. Furthermore, if you forget a password or PIN for one of your wallets, then you may not be able to recover the funds in that wallet.

Should You Keep Crypto in Different Wallets?

It is generally a good idea to keep your cryptocurrencies in different wallets, especially if you are holding a large number of digital assets. This is because it can help to reduce the risk of losing all of your cryptocurrencies in the event that one of your wallets is lost, stolen, or compromised.

One way to diversify your cryptocurrency holdings is to use different types of wallets, such as a software wallet, a hardware wallet, and a paper wallet. This can help to provide an additional layer of security, as each type of wallet has its own unique set of features and benefits.

For example, you could store some of your cryptocurrencies in a software wallet that is connected to the internet and easy to access, while keeping the majority of your holdings in a hardware wallet that is offline and more secure. This can help to balance the convenience of accessing your cryptocurrencies with the security of keeping them safe.

It is also a good idea to use different wallets for different purposes. For example, you could use one wallet for everyday transactions and another wallet for long-term storage of your digital assets.

Overall, it is important to carefully consider your specific needs and goals when deciding how to store and manage your cryptocurrencies. Diversifying your cryptocurrency holdings across different wallets can be a good way to reduce risk and ensure the safety and security of your digital assets.

Why Having Multiple Crypto Wallets is Good

Having multiple crypto wallets is beneficial for a number of reasons. For one, it allows you to diversify your cryptocurrency investments and spread out the risk associated with holding digital assets in a single wallet. This way, if one of your wallets is hacked or loses funds for any other reason, the rest of your holdings are safe from harm.

Additionally, having multiple crypto wallets is a great way to ensure you can easily access all of your funds. For example, if you have more than one cryptocurrency wallet, each holding different currencies, then you can use them to transfer and convert currencies as needed without having to go through the hassle of finding an exchange or other third-party service.

Moreover, having multiple crypto wallets is also a great way to protect your privacy. As each wallet has its own address and private key, it’s more difficult for anyone to track your activity on the blockchain. This way, you can remain anonymous while using cryptocurrencies as long as you avoid reusing addresses across different wallets.

Why Storing Bitcoin in a Single Wallet is a Bad Idea?

There are several reasons why storing all your Bitcoin in one wallet is not a good idea. They include:

- Security Risks: Keeping all your Bitcoin in one wallet increases the risk of theft or loss in case of a security breach. If hackers are able to gain access to your wallet, they will have access to all of your coins at once. This leaves you vulnerable and may result in significant losses.

- Lack of Portability: If all your Bitcoin is stored in one wallet, it can be difficult to move them around. You may need to transfer funds from the wallet multiple times in order to access different exchanges or services. This often takes time and effort, so having a few wallets can make it easier to move your coins quickly.

- Reduced Privacy: Keeping all your coins in one wallet may reduce privacy as you’re more easily traceable. This means that cybercriminals may be able to track your transactions and access your funds if they gain access to your wallet.

Should I Consider Consolidating Multiple Crypto Wallets?

There are pros and cons to consolidating your cryptocurrency wallets, and whether or not you should consider it depends on your specific needs and goals.

One potential advantage of consolidating your cryptocurrency wallets is that it can make it easier to manage and track your digital assets. If you have multiple wallets with different cryptocurrencies, consolidating them into a single wallet can make it easier to see your overall portfolio and make informed decisions about your investments.

Another potential advantage of consolidating your wallets is reducing the risk of losing access to your cryptocurrencies. If you have multiple wallets, it can be easy to forget the login information or private keys for some of them, making it difficult to access your cryptocurrencies.

Dangers Of Not Consolidating Your Wallets

By consolidating your wallets, you can reduce the risk of losing access to your digital assets due to forgotten login information or lost private keys.

However, there are also some potential disadvantages to consolidating your cryptocurrency wallets. One concern is that consolidating your wallets can increase the risk of losing all of your cryptocurrencies in the event that your single wallet is lost, stolen, or compromised. Distributing your cryptocurrencies across multiple wallets can reduce the risk of losing your digital assets in one go.

Another concern is that consolidating your wallets can reduce the security of your cryptocurrencies. If you have multiple wallets with different security measures, consolidating them into a single wallet may mean that you rely on a single set of security measures to protect your digital assets. This can increase the risk of your cryptocurrencies being accessed by unauthorized parties.

Whether or not you should consider consolidating your cryptocurrency wallets depends on your specific needs and goals. It is important to carefully consider consolidation’s potential advantages and disadvantages and weigh them against your own priorities.

How to Manage Multiple Crypto Wallets?

Managing multiple crypto wallets can be a daunting task, but there are some steps you can take to make it easier.

First, creating strong passwords and private keys for each wallet is important. This will ensure that your cryptocurrencies remain secure and that only you can access them. It is also important to back up each wallet regularly in case of theft or loss.

Second, you should use a reliable wallet provider with strong security protocols. This will ensure that your wallets are secure and reduce the risk of unauthorized access to your digital assets. The best wallets, such as Tezro, provide multi-signature security, two-factor authentication, and other measures to protect your cryptocurrencies. You can find more information on the best wallets in our guide to the top cryptocurrency wallets.

Finally, it is important to keep track of your multiple crypto wallets. Having a spreadsheet or other tracking system can make it easier to manage and monitor your wallets, ensuring that all of your digital assets remain secure.

Frequently Asked Questions

Can You Have More Than One Crypto Wallet?

A few overarching questions crypto enthusiasts ask are can you have multiple crypto wallets? Can you have more than one crypto wallet? Well, the answer is a resounding yes. In fact, having multiple wallets can be beneficial as it allows you to store your cryptocurrencies in different locations.

You should always keep most of your digital assets in a secure wallet and use additional wallets for day-to-day transactions or trading.

How Many Crypto Wallets Are There?

It is difficult to accurately determine the total number of cryptocurrency wallets that currently exist, as new wallets are constantly being created and some may not be widely known or publicly disclosed. However, it is estimated that millions of cryptocurrency wallets are in use worldwide.

Is it Better to Use Multiple Crypto Wallets or Just One?

It is generally better to use multiple cryptocurrency wallets rather than just one. This will help you keep your funds safe and secure. It also means that you are less likely to lose all of your funds in the event of a hack or security breach.

Additionally, if you are trading cryptocurrencies, it can be useful to have different wallets for different currencies to make trading easier and more convenient.

Key Takeaways

- You can have multiple wallets at once, including hardware, software and paper wallets.

- It is safer to use multiple wallets to keep your funds safer and secure.

- In case of a hack or security breach, you are less likely to lose your savings.

- Having different wallets for trading day-to-day transactions is an intelligent decision.

Final Thoughts

Cryptocurrencies are valuable assets, and having multiple crypto wallets can enable you to make the most of them.

However, managing multiple crypto wallets can be difficult, so it is important to understand how many crypto wallets you can have and consider whether or not consolidating them is the best option for your needs.

By using this article as a guide and following the tips provided, you should be able to manage your digital assets securely and efficiently. Tezro app can help since it’s an encrypted software wallet that you can have on your fingertips.